The International Gas Union (IGU) released its World LNG Report, providing information on key developments and trends in the LNG sector.

As the report says, LNG trade in 2020 was heavily impacted by COVID-19, as markets, cities and producers across the globe wrestled with lockdowns and a multitude of other disruptions. Significant reductions in levels of economic activity affected demand, which in turn had to be balanced by supply curtailments, a balancing act to reconcile demand shocks with contracting, operational and market dynamics.

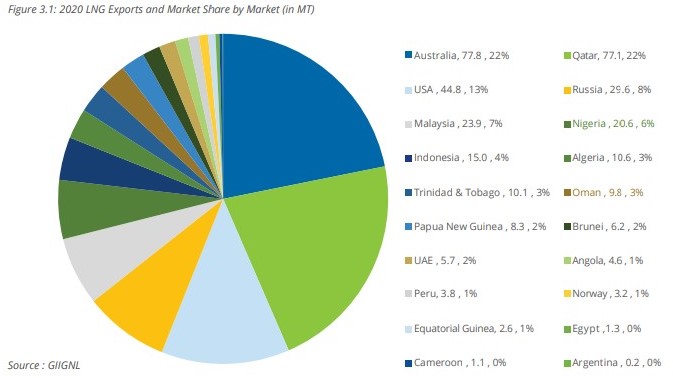

At the beginning of 2020, Rystad Energy projected LNG trade to grow 8% year-on-year, but the pandemic impact caused it grow only slightly to 356.1 MT , with the total number of LNG voyages growing by only 1% from 2019. However, it was one of the few commodities that showed growth in 2020, demonstrating the resilience, flexibility and reliability of the gas sector

IGU noted.

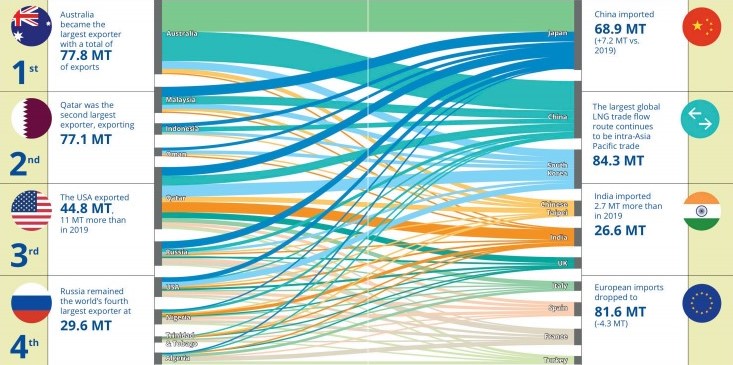

The first impact of the virus was felt when Asian LNG imports started to fall towards the end of February, as Japan, China and South Korea experienced lower economic activity. This was against the backdrop of a relatively warm winter and high inventory levels. As China went into lockdowns, many cargoes were diverted to India and South Korea. Supply remained healthy in the first quarter as Qatar and Australia maintained production, and US producers still attempted to ramp up output.

This excess supply was absorbed by Europe once many Asian markets went into lockdowns, with buyers taking advantage of low prices, substituting some piped gas with LNG. However, Spain, Italy and France – the largest importers in Europe – soon also announced lockdowns

By the end of March, Europe’s storage filled up, and buyers began using flexibility clauses in their US offtake contracts to cancel cargos for summer deliveries, causing Gulf Coast LNG terminals to cut exports.

Reacting to the effects of COVID-19 on European and Asian demand, coupled with seasonal demand fluctuations, US LNG exports fell by 70% from May to August, mostly from curtailments by Sabine Pass and Corpus Christi. Trade flows towards Asia regained some ground in 3Q 2020 as demand in China and India outweighed a decrease in shipments to Japan and South Korea.

This can be attributed to lower overall utlisation rates in the larger importing nations due to an overall drop in global gas demand, allowing for opportunistic buying. Balancing out the pandemic’s negative impact on demand, a very cold Northern hemisphere winter, together with a tighter freight market, spawned an LNG supply squeeze towards the end of 4Q 2020

according to IGU.

LNG shipping

The global pandemic crisis created a challenging business environment for vessel owners and operators in the LNG shipping sector. The main themes affecting LNG shipping through this unprecedented year have been:

- Significant demand disruption

- Subsequent sustained lower charter rates

- Increased use of floating LNG storage

- Shift towards new ways of working, and delays in newbuild deliveries.

The reduction in global gas consumption led to supply curtailments and thus demand disruption for LNG freight. American exports of LNG became less economic for most companies based on netback pricing, while virus-related market conditions often caused vessels to change course mid-voyage.

For example, in early February, four carriers from the Middle East were forced to change route or even return to the Gulf. While US curtailments primarily balanced the market, non-US curtailments due to economic and operational factors contributed to supply tightness. The consequence of this through the year was cargo cancellations as LNG players balanced oversupply and uncertain global demand

In addition, reduced demand for shipping saw spot prices shift lower from January through mid-March, before staging a brief rally caused by arbitrage opportunities between basins.

The slow steaming of LNG carriers to maximise trading positions is usually only executed as a short-term bridge into winter, but the spread of COVID-19 incentivised the use of this option to manage demand disruption.

Historically, high operating expenditure and boil-off gas rates have hindered players from storing LNG at sea even in the short-term, using vessels almost exclusively for transport

highlights IGU.

However, excess gas supply and low freight rates incentivised the use of loaded vessels as short-term storage at sea earlier in the year. The economics of doing so were further boosted by the availability of newer vessels with lower boil-off gas rates, many of which are not on long-term charters.