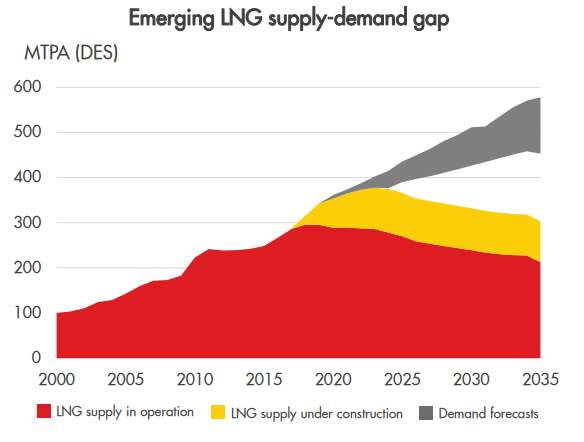

The LNG market continues to perform above expectations, as its demand grew by 29 million tonnes to 293 million tonnes in 2017, according to Shell’s annual LNG Outlook. However, based on current projections, Shell predicts a supply shortage in mid-2020s, unless new LNG production project commitments are made soon.

Japan is still the world’s largest LNG importer in 2017, while China moved into second place, surpassing South Korea. Total demand for LNG in China reached 38 million tonnes, due to continued economic growth and policies to reduce air pollution through coal-to-gas switching.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

Maarten Wetselaar, Integrated Gas and New Energies Director at Shell, mentioned:

We are still seeing significant demand from traditional importers in Asia and Europe, but we are also seeing LNG provide flexible, reliable and cleaner energy supply for other countries around the world. In Asia alone, demand rose by 17 million tonnes. That’s nearly as much as Indonesia, the world’s fifth-largest LNG exporter, produced in 2017.

LNG has played an important part role in the global energy system the last decades. Since 2000, the number of countries importing LNG has grew four times more and the number of countries supplying it has doubled. LNG trade also saw an increase from 100 million tonnes in 2000 to nearly 300 million tonnes in 2017. That amount of gas can provide power for around 575 million homes.

In 2017, the number of LNG spot cargoes that were sold reached 1,100, meaning that three cargoes were being delivered every day. This growth is mainly caused because of the new supply from Australia and the USA. However, LNG buyers continue to sign shorter and smaller contracts.

The difference between buyers and suppliers is caused because most suppliers want long-term LNG sale, but LNG buyers want shorter, and more flexible contracts to compete in their own downstream power and gas markets.

In summary, Shell’s outlook mentions the following:

- 11% increase in LNG imports;

- Physical and financial liquidity increases as market evolves;

- Gas supports renewable power generation and provides cleaner non-power energy supply;

- Multiple levels of policy support gas and LNG demand created;

- Supply investment required to meet long-term demand growth;

You can see Shell’s full outlook about LNG, by clicking the following PDF