As EIA informs, during winter 2018-2019, imports of LNG at terminals serving New England played an important role in moderating natural gas prices in the region. LNG imports are regasified at these terminals and then sent to natural gas distribution networks.

These sendout volumes rose during times of high spot natural gas prices at the Algonquin Citygate, which is a widely referenced trading hub and benchmark for natural gas prices in New England. This development limited further increases in spot prices.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

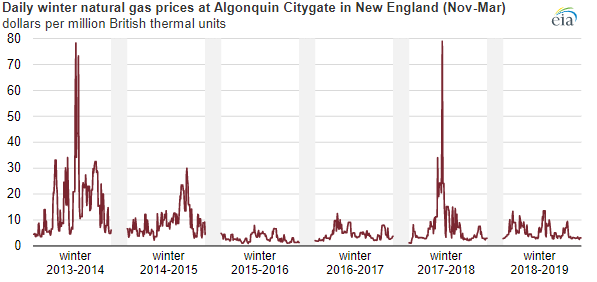

According to EIA, spot natural gas prices in New England are more volatile during winter months, as cold weather drives increasing regional natural gas demand and leads to more congestion on the natural gas pipeline network.

Due to the fact that New England does not have underground natural gas storage infrastructure and is not a natural gas-producing region, LNG imports to the region are considered a key marginal source of natural gas supply during times of high natural gas demand in the winter.

What is more, during the bomb cyclone event in early January 2018, spot natural gas prices at Algonquin Citygate grew to almost $80 per million British thermal units (MMBtu) on January 4, 2018. During the most recent winter, daily prices at Algonquin Citygate were less than $14/MMBtu and averaged about $7/MMBtu in January and February.

Currently, New England receives LNG imports from three regional regasification facilities:

- The Canaport LNG onshore terminal (1.0 billion cubic feet per day (Bcf/d) capacity) in New Brunswick, Canada;

- The Everett LNG onshore terminal (0.7 Bcf/d capacity), near Boston, Massachusetts;

- The Northeast Gateway Deepwater Port offshore terminal (0.4 Bcf/d capacity), also near Boston.

In addition, from November 2017 through March 2018, LNG imports into New England averaged 0.14 Bcf/d and marked their peak at 0.88 Bcf/d on January 6 during the bomb cyclone event. From November 2018 through March 2019, LNG imports into New England averaged 0.24 Bcf/d and peaked at 1.48 Bcf/d on February 1.

Finally, rising LNG imports were not the only factor that moderated spot natural gas prices in New England during winter 2018-2019. Namely, cold weather events last winter were more episodic in comparison to the sustained cold weather in the polar vortex event in January 2014 and the bomb cyclone event of January 2018.