The Red Sea crisis has emerged as a critical flashpoint of the conflict in the Middle East, upending global trade and maritime transport, port activity in the MENA region, and ecological balance of the Red Sea, according to the World Bank.

On its recent report ‘The Deepening Red Sea Shipping Crisis: Impacts and Outlook’, the World Bank provides an update nearly a year after the crisis began, offering an expanded analysis and reflections on the highly uncertain outlook.

Persistent Conflict in the Red Sea Region

The shipping crisis in the Red Sea region has deepened. Particularly around Yemen, the region remains a complex flashpoint for conflict since the onset of the Middle East crisis in October 2023.

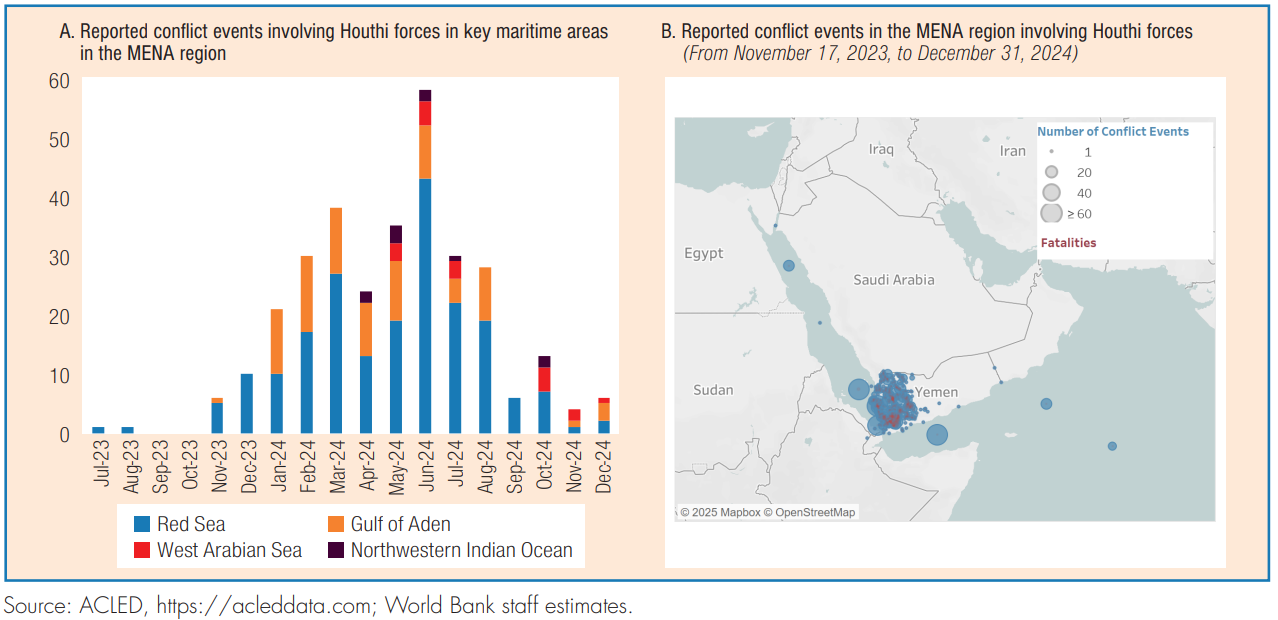

Initially limited to Yemen, the conflict involving the Houthis has expanded to critical maritime zones, including the Red Sea, Gulf of Aden, Arabian Sea, and Northwestern Indian Ocean, resulting in over 300 conflict events between October 2023 and December 2024.

Within the Red Sea alone, Houthi forces have conducted 201 attacks on commercial vessels during this period, resulting in 12 fatalities. In a broader context, Houthi forces have been involved in over 2,300 conflict-related events across the MENA region since October 2023, resulting in a total of 1,467 lives lost.

Within the Red Sea alone, Houthi forces have conducted 201 attacks on commercial vessels during this period, resulting in 12 fatalities. In a broader context, Houthi forces have been involved in over 2,300 conflict-related events across the MENA region since October 2023, resulting in a total of 1,467 lives lost.

Trade Diversion and Disruptions

Attacks on commercial vessels in the Red Sea, a vital corridor for nearly a third of global container traffic, have severely disrupted regional and global maritime operations. Security threats in the Red Sea have compelled ships on the Asia-Europe and Asia-North Atlantic trade lanes to be rerouted around Africa’s Cape of Good Hope.

In addition, trade diversion around the Cape of Good Hope led to a sharp increase in the travel distances and times of vessels that once frequented the Red Sea. By October 2024, travel distances for cargo ships and tankers that previously passed through the Red Sea had risen by 48 and 38 percent, respectively, compared to the pre-conflict baseline of January to September 2023.

The Red Sea shipping crisis has profoundly disrupted the global supply chains. The World Bank’s Global Supply Chain Stress Index, a measure of the delayed container shipping capacity that was held up due to port congestion or closures, rose to 2.3 million TEUs in December 2024. This is more than double the levels recorded in December 2023 and similar to the peak seen in March 2022 during severe container traffic congestion amid the COVID-19 pandemic.

Furthermore, disruptions in the Red Sea shipping route have caused significantly longer supplier delivery times, especially in Europe.

Environmental Damage, Disrupted Fishing, and Internet Outages

Houthi attacks on ships in the region have caused significant environmental damage from oil spills and the potential release of hazardous cargo such as fertilizer. Since March 2024, dozens of vessels carrying fertilizer, heavy fuel oil, and marine diesel have been attacked and sunk by the Houthis.

Moreover, leaked fuel and fertilizer have harmed marine ecosystems, severely disrupting fishing activity in the region and threatening desalination plants critical for supplying drinking water.

Attacks on ships have also caused damage to communication cables, disrupting global internet connectivity.

Impact on Freight Rates and Inflation

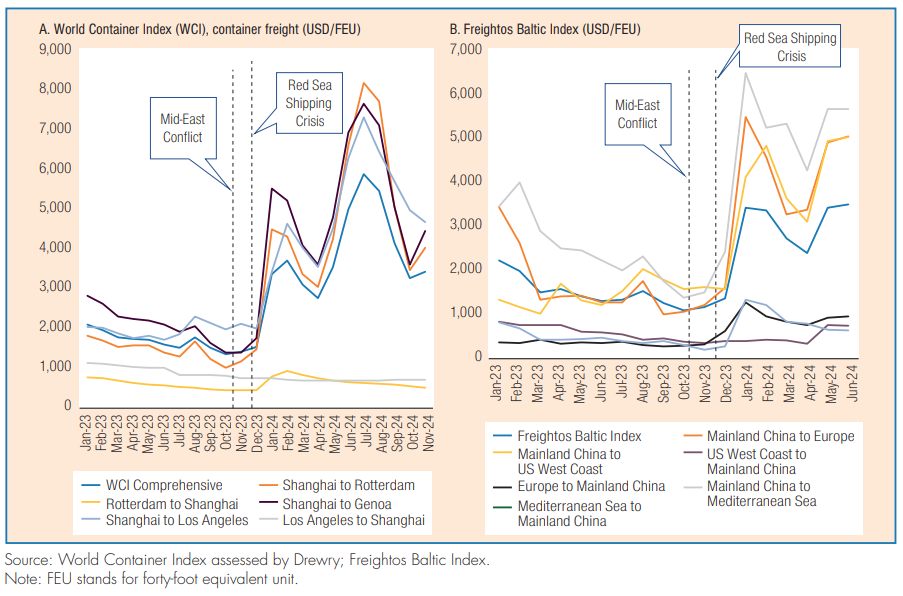

The disruption of maritime transportation in the Red Sea has driven up global shipping costs, with the sharpest increases observed on routes directly affected by the hostilities. The rise in shipping costs, however, has had muted effects on inflation so far.

Outlook

With the ceasefire between Israel and Hamas taking effect on January 19, 2025, and the Houthis stating they will limit attacks on commercial vessels to Israel-linked ships, the potential for reduced disruptions to global maritime trade has increased. The peace dividend scenario was motivated by the hope of durable peace in the region on the heels of the ceasefire agreement and the resumption of normal traffic in the Red Sea.

In conclusion, the resolution of the Red Sea shipping crisis would lead to substantial peace dividends for global maritime trade, with varying impacts depending on the duration of the crisis. Under the baseline scenario, where the crisis lasts until October 2025, the growth of shipping trade would mirror the previous year.

However, under a gradual recovery scenario, where the crisis ends by May 2025, both imports and exports would see noticeable improvements, with significant gains in Red Sea MENA countries and the European Union.

A rapid recovery scenario, where the crisis ends by February 2025, would result in even more pronounced benefits, with shipping imports and exports in both regions experiencing strong surges. These potential improvements underscore the importance of an early resolution in driving stronger recovery across global shipping trade.