As part of the recently published BP Energy Outlook for 2018, BP’s chief economist, Spencer Dale, explores where oil demand is headed until 2040. Mr. Dale highlights that demand for liquid fuels grows over much of the Outlook, although in the ET scenario, the rate of growth gradually slows and plateaus in the years after 2040.

Namely, the transport sector continues to dominate global oil demand, accounting for more than half (8 Mb/d) of the overall growth in demand, with its share in total oil demand remaining relatively stable at a little over 55%. Non-road (4 Mb/d) and trucks (3 Mb/d) account for the majority of growth, with a smaller increase in cars and motorbikes (1 Mb/d).

However, the stimulus from transport demand gradually fades as the pace of vehicle efficiency improvements quickens and alternative fuels penetrate the transport system. Liquid fuels used by the transport system stop growing towards the end of the Outlook.

The non-combusted use of oil, particularly as a feedstock within petrochemicals, takes over as the main source of growth for liquids demand after 2030, reflecting the more limited scope for efficiency gains relative to transport. Over the Outlook as a whole, non-combusted uses of liquid fuels increase by 7 Mb/d.

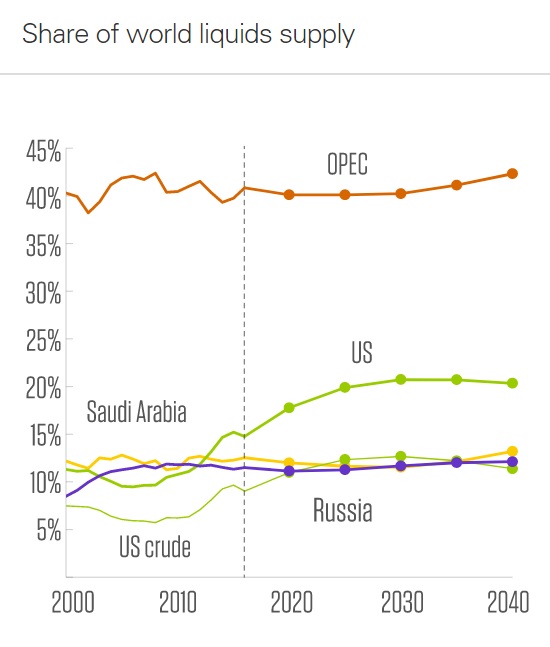

In the ET Scenario, growth of global oil production is driven by low-cost producers, especially US tight oil and Middle-East OPEC. Increases in oil production during the first part of the Outlook are dominated by US tight oil: Total US liquids production, including natural gas liquids (NGLs), account for 2/3 of the increase in global supply during the first 15 years of the Outlook, plateauing at around 23 Mb/d in the early 2030s.

In the final 10 years of the Outlook, production growth is increasingly driven by OPEC. The abundance of global oil resources is assumed to prompt OPEC members to reform their economies, reducing their dependency on oil and allowing them gradually to adopt a more competitive strategy of increasing their market share.

For there to be sufficient oil supplies to be able to meet demand in any of the scenarios considered requires significant levels of new investment in oil production. If there were no new investment in oil production from today, and existing production declined at 3% p.a., global oil supplies would be around 45 Mb/d in 2040.

However, this slower growth in liquids demand combined with continued growth of NGLs and biofuels will likely put pressure on global refining. In the ET scenario, liquid supplies grow by around 11 Mb/d, of which only 3 Mb/d is accounted for by crude and condensates which need to be refined, with the rest met by NGLs (6 Mb/d) and biofuels and other liquids (3 Mb/d).

The gradual plateauing in product demand combined with continuing steady growth in non-refined liquid supplies, causes refinery runs to peak in the mid-2030s. New refinery projects which are already planned or under construction for the next five years or so are sufficient to meet all of this additional throughput, implying no net new refining capacity is needed beyond this, BP says.

Explore more by reading the full Outlook here.