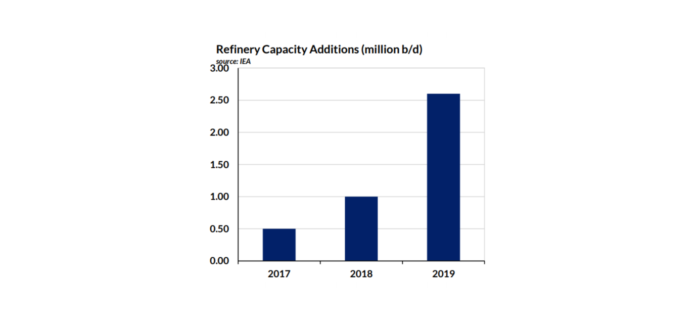

Gibson Shipbrokers published a Weekly Tanker Market Report, on January 25, based on EIA’s recent report that 2019 is expected to see the largest wave of refinery capacity additions. Gibson expects that 2.6 million b/d of new capacity will initiate operations this year. In terms of pure volumes, this is an optimistic sign for the product tanker market. Yet, the report focuses on how global product flows shape up.

According to the report, more product will be pushed out of both Far East and Middle East during 2019, since both regions will see great product expansion, with Latin/South America, Africa and Europe being the primary demand outlets for exporters.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

However, as 2020 comes closer middle distillates are expected to serve as the primary route to compliance with the 0.5% sulphur cap.

In theory, higher demand should support arbitrage, mainly from East to West. Yet, Asia’s gasoil length is expected to be reduced through higher regional demand for low sulphur fuels, which may limit the growth in exports out of the region.

Also, the impact of the new refining capacity will burst in the second half of 2019. As a result, shipowners should endure a weak six months prior to the boost.

The report states that seasonal factors will also play a role, as spring is likely to limit export volumes over the following months, while higher new-build volumes will continue posing challenges to the product tanker market.

Concluding, moving into the second half of 2019, a combination of higher flows, the preparations for 2020 and the impact of new refineries will be visible, letting 2019 finish as powerfully as it started.

For more information, click the PDF below: