In its weekly report for 12-20 March, Fearnleys said that VLCC activity has been far disappointing, the market for Aframaxes trading in the North Sea and Baltic came off significantly, while for the Suezmax type, continued sparse activity in the West has allowed Charterers to pull rates even further down.

VLCC

With the March VLCC MEG program behind, the owning community was looking forward to a sprout of activity for early April with ambition to push rates up in to the ws60 eastbound. However, activity has thus far been disappointing, Fearnleys said.

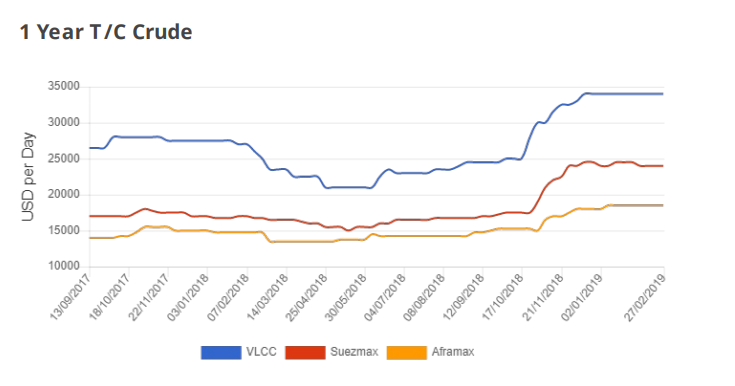

Ws59 is last done for a MEG/China run, although still about USD 30k per day in t/c returns on a non eco modern ship – well above historic returns for time of year. USG activity has also halted, and a handful of owners having ballasted their ships from the east on spec are nervously awaiting fresh export cargoes to take them back east.

Suezmax

Continued sparse activity in the West has allowed Charterers to pull rates even further down. The 1st decade in West Africa has been worked at a pedestrian pace with ships being picked off quietly and owners just content to cover cargoes closest to their dates.

Meanwhile, there has been a reversal of fortunes in the MEG with a flurry of action for first decade April dates and owners managing to wrestle back some control as the list has tightened.

The Turkish delays have slowly decreased, and this has allowed more fluidity in the availability for the Black Sea, TD6 has come off to ws70 at the time of writing.

The week ahead has a softer tone with still too many ships available and cargoes not seemingly increasing in volume.

Aframax

The market for Aframaxes trading in the North Sea and Baltic came off significantly this week. Rates came under downward pressure due to lack of activity and tonnage building up. Everyone is now waiting to hear when ice restrictions in certain Baltic ports will be lifted. We expect this soft trend to continue.

In the Mediterranean and Black Sea, we have seen TD19 (cross-Med) drop to ws85 levels at the time of writing.

Over the past week rate levels ex Black Sea have dropped from more than ws100 to sub-90 levels. On a lighter note, the current week started with a boost in activity as a steady flow of cargoes have come into the market decreasing the tonnage build up in the area and creating an optimistic vibe among owners, who hope to see an upturn towards the end of the week, as there currently are not any obvious alternative markets to flee to.

Explore more herebelow: