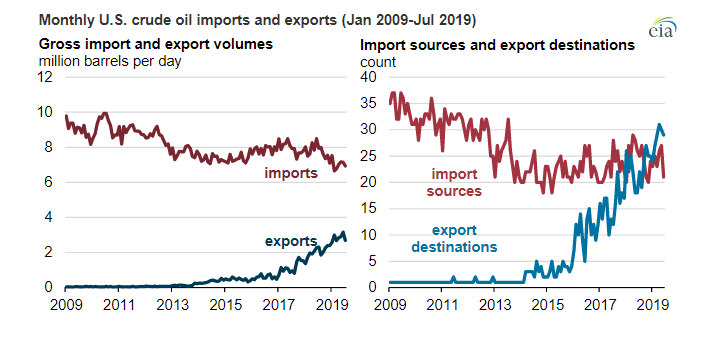

As US crude oil export volumes have increased to an average of 2.8 million barrels per day (b/d) in the first seven months of 2019, the number of destinations (which includes countries, territories, autonomous regions, and other administrative regions) that receive US exports has also increased, according to EIA.

Earlier this year, the number of US crude oil export destinations surpassed the number of sources of US crude oil imports that EIA tracks.

In 2009, the US imported crude oil from as many as of 37 sources per month. In the first seven months of 2019, the largest number of sources in any month fell to 27.

As the number of sources fell, the number of destinations for US crude oil exports rose. In the first seven months of 2019, the US exported crude oil to as many as 31 destinations per month.

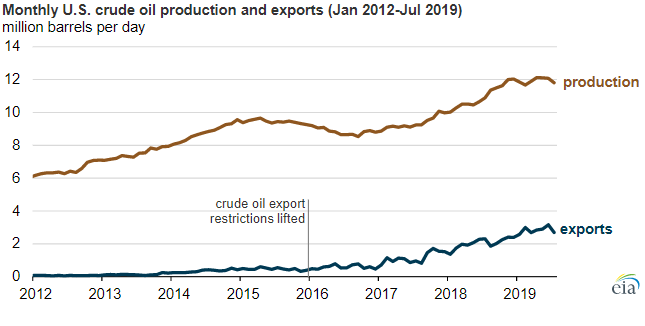

This rise in US export destinations coincides with the late 2015 lifting of restrictions on exporting domestic crude oil.

Before the restrictions were lifted, US crude oil exports almost exclusively went to Canada.

Before the restrictions were lifted, US crude oil exports almost exclusively went to Canada.

Between January 2016 (the first full month of unrestricted US crude oil exports) and July 2019, US crude oil production increased by 2.6 million b/d, and export volumes increased by 2.2 million b/d.

The United States has also been importing crude oil from fewer of these sources largely because of the increase in domestic crude oil production.

Most of this increase has been relatively light-sweet crude oil, but most US refineries are configured to process medium- to heavy-sour crude oil.

US refineries have accommodated this increase in production by displacing imports of light and medium crude oils from countries other than Canada and by increasing refinery utilization rates.

Conversely, the United States has exported crude oil to more destinations because of growing demand for light-sweet crude oil abroad.

Several infrastructure changes have allowed the United States to export this crude oil.

New, expanded, or reversed pipelines have been delivering crude oil from production centers to export terminals.

Export terminals have been expanded to accommodate greater crude oil tanker traffic, larger crude oil tankers, and larger cargo sizes.

The upcoming 2020 sulphur cap is also affecting demand for light-sweet crude oil.

Many of the less complex refineries outside of the US cannot process and remove sulfur from heavy-sour crude oils and are better suited to process light-sweet crude oil into transportation fuels with lower sulphur content.

See also: