As U.S. Energy Information Administration (EIA) forecasts in its latest latest Short-Term Energy Outlook (STEO), that there will be higher crude oil prices in the second half of 2023 and into 2024, because of moderate but persistent inventory drawdowns.

As EIA explains, inventory drawdowns take place when demand for a commodity is greater than the supply of that commodity. Expected production cuts from OPEC members and expected higher petroleum consumption will lead to an average inventory drawdown of 0.4 million barrels per day (b/d) between July 2023 and the end of 2024.

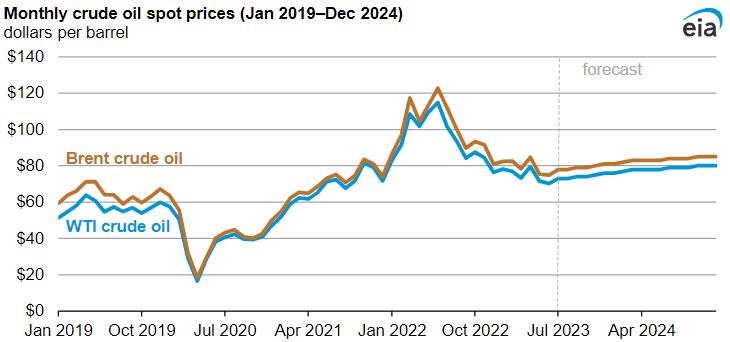

The forecast Brent crude oil price will increase to the mid-$80 per barrel range by the end of 2024, up from the June 2023 average of $75 per barrel. EIA predicts the West Texas Intermediate crude oil price will follow a similar path and maintain a discount to Brent of $5 per barrel.

On June 4, OPEC+ members agreed to extend crude oil production cuts through the end of 2024. The cuts had previously been set to expire at the end of 2023. Following the June 4 meeting, Saudi Arabia also announced a new voluntary oil production cut of 1.0 million b/d for July and August 2023.

On June 4, OPEC+ members agreed to extend crude oil production cuts through the end of 2024. The cuts had previously been set to expire at the end of 2023. Following the June 4 meeting, Saudi Arabia also announced a new voluntary oil production cut of 1.0 million b/d for July and August 2023.

EIA also estimates that Saudi Arabia produced about 10% of global production of petroleum and other liquid fuels, or 10.1 million b/d, in June 2023. The Administration forecasts OPEC production of petroleum and other liquid fuels will average 33.9 million b/d in 2024, down 1.2 million b/d from the group’s 2022 peak of 35.1 million b/d.

These production cuts will keep total OPEC production below the pre-pandemic five-year (2015–19) average of 36.2 million b/d and reduce OPEC’s share of world production to 33% in 2024, down from the pre-pandemic average share of 37%.

EIA has slightly increased forecasts for world petroleum consumption in recent months, in contrast to our downward revisions in world petroleum production. It expects non-OECD consumption of petroleum and liquid fuels to grow by 1.6 million b/d from 2022 to average 55.1 million b/d in 2023 and to rise further to 56.5 million b/d in 2024.

China and India lead EIA’s forecast of consumption growth. EIA expects petroleum and liquid fuels consumption in China to grow by 0.8 million b/d in 2023 and by 0.4 million b/d in 2024; India’s consumption is forecast to grow by 0.3 million b/d in both 2023 and 2024.

Oil prices in 2023 have been considerably less volatile than they were between 2020 and 2022. However, changes in world production and consumption could result in significant differences in oil prices than in our forecast for 2024, EIA notes.