Container shipping lines are increasing their share of the seaborne reefer market and are forecast to accelerate their assault over the coming years, according to global shipping consultancy Drewry.

In 2016, the estimated perishable reefer cargo split was 79% in reefer containerships and 21% in specialised reefers. By 2021, this modal split is forecast to have changed to nearer 85% and 15% in reefer containerships and specialised reefers respectively, Drewry noted.

The resilience of the industry to adverse economic, commercial and even climatic conditions has been demonstrated once again as seaborne perishable reefer trade increased in 2016 and is forecast to grow further still in 2017. By 2021, seaborne reefer cargo will exceed 134 million tonnes – increasing by an average of 2.8% per annum, according to Drewry’s report.

Despite future seaborne cargo growth levels being lower than those of the last decade (3.3%), such increases will have a significant effect on container lines with reefer capacity. Based on the confirmed orderbook, despite significant increases in reefer capacity, reefer utilisation will remain broadly stable as a result of the increased seaborne cargo volumes and rising market share for the reefer containership mode.

On the other hand, with a reducing specialised reefer fleet, not only will this mode see its cargo volumes decrease, but also its market share will reduce year-on-year. Nevertheless, it currently provides around 5% of overall reefer capacity yet carries almost 21% of total seaborne perishable reefer cargo. Inevitably, although still carrying a disproportionate volume of cargo, both cargo tonnes and market share are set to fall for this mode.

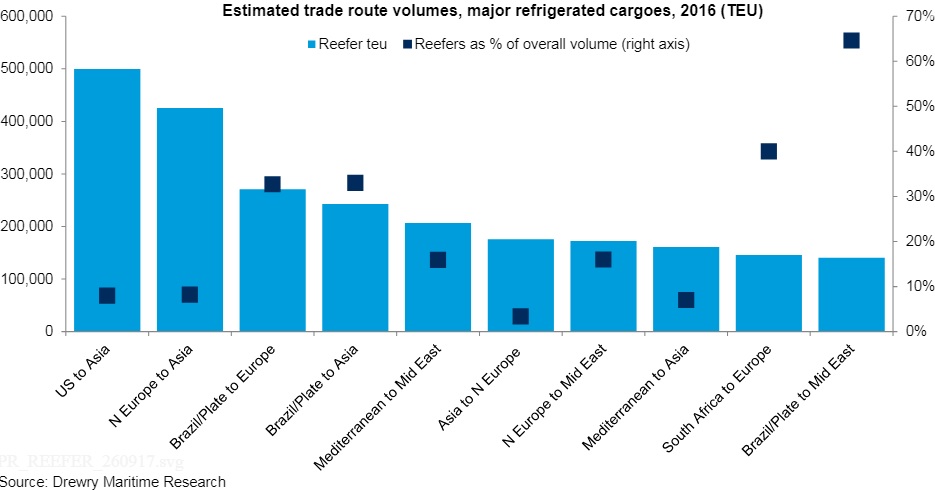

In addition, the report looks at almost 30 key trade lanes and compares reefer TEU volumes for 2016 with those for 2015, as well as calculating the reefer percentage of the overall (reefer and dry) trade.

Further, Drewry has noted a lack of recent investment leading to shortages in Europe and Brazil during the second quarter of this year, a situation that is likely to repeat itself. Although carrier consolidation may result in an improvement in container utilisation and efficiency, the lack of container equipment orders placed in 2017 is a concern.

“The reefer sector continues to report strong cargo growth which is very encouraging for vessel operators. However, the transition from the specialised operators to the reefer containership operators is gaining momentum”, said Drewry’s report editor Kevin Harding.