During the 2023 GREEN4SEA Athens Forum, Mr. Constantinos Chaelis, Global Gas Markets & Technology Lead, Lloyd’s Register, displayed a market outlook update on the LPG and ammonia gas value chains.

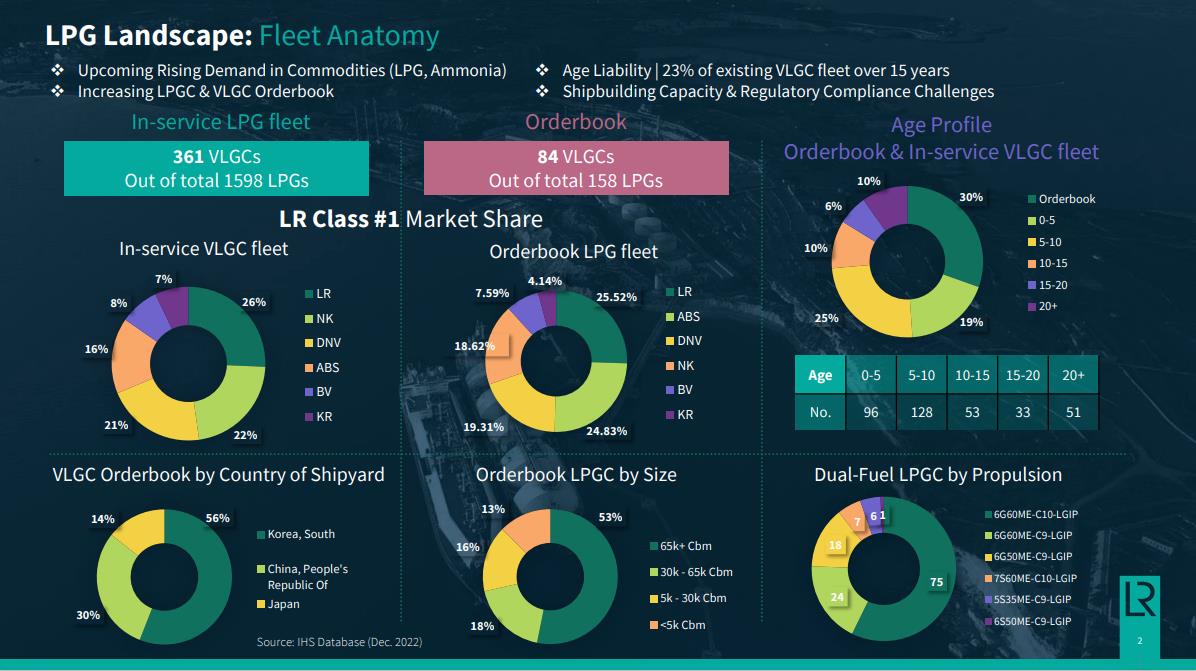

The market continues to experience an upcoming rising demand in the LPG world seaborne trade, estimated to be reaching 128 million tonnes by 2024, followed by an increasing LPG carrier (LPGC) new construction activity. Interestingly, it is worth noting the price range of LPG commodity between different regions, ranging on average from $1,800/ton in North America to over $300/ton in Middle East & Africa.

Considering the shipbuilding capacity on its knees – ordering a ship tomorrow if there was a slot availability, the earliest delivery would be 2026 or 2027 and considering Korean yards at their maximum capacity with flooded LNG orders – owners are more actively engaging with Chinese yards, such as Jiangnan Group focusing on the VLGC construction.

The presentation provides a heat map of LPG Terminals by Country considering Port Calls over 12hrs for Loading/Discharging operations, based on AIS vessel data, including a list of the Top 10 Loading & Discharging countries arranged by frequency of port calls, including global trade routes per ship size.

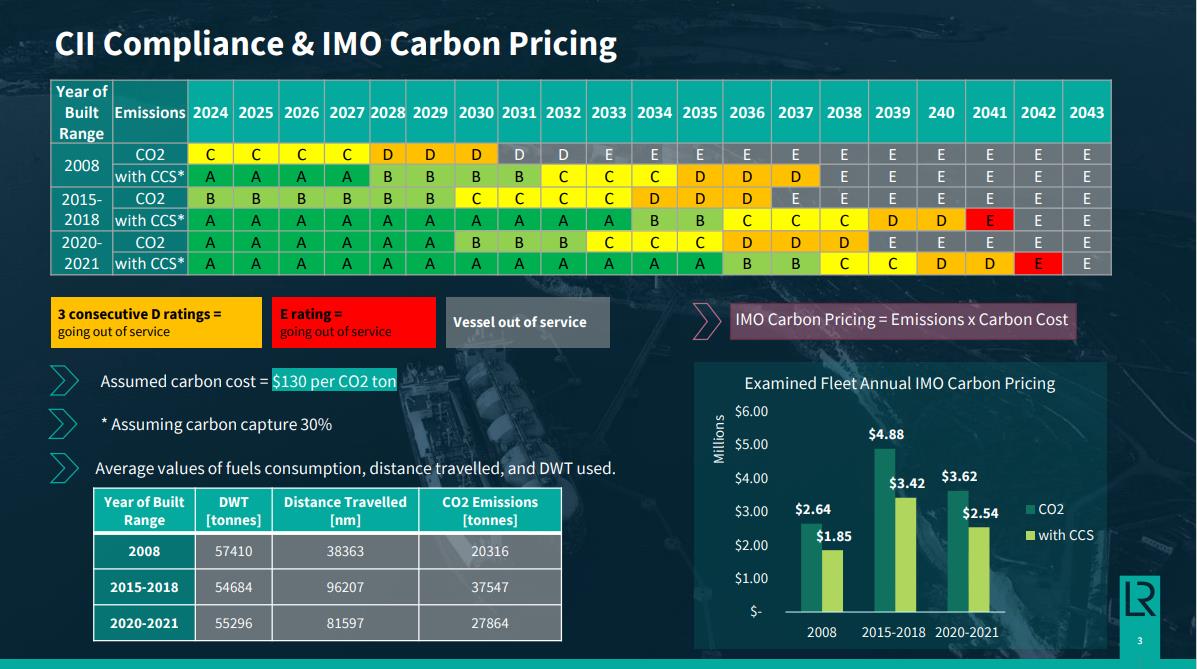

From a Regulatory perspective, compliance challenges hovering at our doorstep with CII implications and consideration of Waiting Time Clause under Time Charter Party Agreements Age Liability with 23% of in-service VLGC fleet over 15 years not fitted with LPG dual-fuel propulsion. To put this into perspective, if built on 2008 the ‘’doing nothing’’ scenario would not offer for much longer trading opportunities, while always considering their operating profile, whereas if assumed 30% carbon capture (*),an asset life extension up to 7 years is noted.

It is also worth noting that recently delivered ships being more efficient and environmentally friendly do face less carbon pricing costs (IMO carbon pricing, EU ETS, FuelEU).

In terms of the LPG prospects, considering the upcoming rising demand in the Ammonia commodity, both as cargo and as fuel, we note a number of scaling up opportunities and transition portfolio pathways for MGCs/VLGCs into the ammonia supply value chain. In addition, the old and new Panama Canal factors may affect the decision making for 88k or 91k VLGC designs that we currently see in Korea and China. From the IMO LCA guidelines perspective, we are hoping for improved and certified actual values versus default which are to be determined at the next MEPC 80th session in July 23.

The underdog is the renewable and recycled DME which is defined as a fuel produced from renewable sources such as biomass or from renewable electricity with carbon capture and it does have significantly lower carbon intensity and when mixed with LPG, it could reduce up to 30 percent the emissions. We see the max blending ratio of DME and LPG 30 to 70 percent; 30 DME and 70 LPG and there are currently production companies in the UK and U.S working towards that blend.

Also, it is worth noting our current work with the World LPG Association (WLPGA); we are jointly developing an ‘LPG as fuel’ guide with WLPGA and we are also doing a feasibility study with a major container ship company in order to retrofit a dual fuel LPG engine on a container ship for which the operating profile in West Africa is offering more opportunities considering the ship size, economies of scale and lower commodity cost.

Therefore, if we put the transition portfolio into perspective, the following should be considered:

#1 LPG Greening – Certified Factors: Extending savings to the full potential of WtT (Well-to-Tank)

#2 Bio or r-LPG Blending: Ensuring incremental compliance

#3 Renewable & Recycled DME: Identified as key prospect by EMSA

#4 Carbon Capturing: Taking a step to meeting the IMO ambition

#5 Ammonia & Methanol Compatibility: Realizing the full potential of transition pathway

The VLGC of the future could look into hybrid electric dual fuel propulsion with a possible deadweight increase without really affecting the key ship particulars; so, not to restrict the trading but offer more operational flexibility. Also, there are several projects ongoing for AiPs in terms of ammonia fuel.

3 key technology pathways

#1 LPG Dual-Fuel Main Engine

The LFPF(GC,PG) notation refers to a vessel designed, constructed and tested to operate on low-flashpoint fuels, in this case petroleum gas.

- Providing on-hand increased monitoring throughout the build and FAT of M/E.

- Providing on-site, seamless installation and commissioning of M/E

#2 Future-fuel Readiness

LR’s LFPF (GC, AM) Ammonia notation and gas ready GR(AM,A) descriptive note allows you to prepare for a future of burning ammonia as fuel, by designing, approving and installing the necessary systems at the time of new construction.

#3 Carbon capture and storage (CCS)

LR’s EACCS notation & READY (EACCS()) descriptive note allows you to prepare for a future retro-fit at the new building stage, saving you time and money in the long-term.

In terms of the value chain for ammonia, mainly only 10 percent of ammonia production is currently internationally traded and basically over half of the produced ammonia is turned into urea for fertilizers. However as per the International Energy agency, it is estimated by 2050, 20 million tons per year to be internationally traded out of the 200 produced and is expected a demand of 85 million tons per annum by 2030. The most active projects for expansion in terms of dynamics we see, are the following five: Oman, Australia, Saudi Arabia, Mauritania and Chile.

Today, we see around 1.3 to 2 million tons per annum from Middle East, Gulf to Northeast Asia and by 2040 an increased production up to 25 to 200 Millions mainly in middle east, Europe, North East Asia, China etc Lloyd’s Register has developed several documentation working on ammonia. The main driver for increasing ammonia production and demand is the co-firing plants and the green steel production mainly we see now in Japan.

In terms of projects, we see interest and potential in scalability; so the first is a 150 000 cubic meters design and if we consider that ammonia as fuel has its own hazards, dangers and complications, we do see an increasing interest from Asian owners to explore the FSU/FSRU options. As such, there are currently AiPs and JDPs in place for a 60 to 80k design for an ammonia FSRU. Looking at a longer term, we could see the ammonia to hydrogen carrier capability. With regards to ammonia fuelled ammonia carriers (VLACs), there are currently AiPs for a 95 000 design cubic meters.

Lloyd’s Register is continuously working with top gas stakeholders, trying to assist and basically navigate the transition pathways.

Above article has been edited from Mr. Constantinos Chaelis’ presentation during the 2023 GREEN4SEA Athens Forum.

Explore more by watching his video presentation here below

The views presented are only those of the author and do not necessarily reflect those of SAFETY4SEA and are for information sharing and discussion purposes only.