Many of China’s major bulk imports, such as iron ore and crude oil, have seen strong growth so far this year despite the COVID-19 pandemic, but imports of coal have followed the opposite trajectory, says Peter Sand, Chief Analyst at BIMCO. This year’s coal import volumes have seen the lowest growth rate in the past three years.

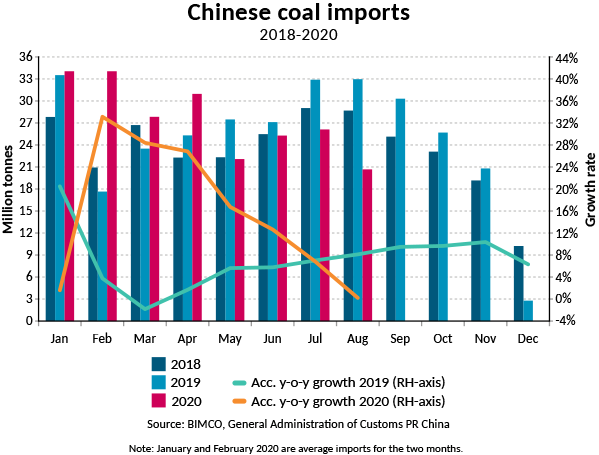

Despite a staggering high growth in January through April, monthly coal import growth rates in May through August were below the levels of the same months in 2019.

Specifically:

- In the first eight months of this year, 220.7 million tonnes of coal have been imported by China, just 473 thousand tonnes more than in 2019, recording a 0.2% growth.

- The strong start seen in the beginning of the year when imports saw a 33% accumulated growth rate in the first two months, was merely a consequence of the low volumes imported in the last months of 2019. The following months have seen much lower volumes with August imports at 20 million tonnes, the lowest import level of 2020.

The drop in coal imports has resulted in less business for the dry bulk fleet. Between May and August this year, there were 26.2 million tonnes less imported compared to the same period last year. The drop in volumes means that ship owners lost an equivalent of 351 Panamax loads. So far, strong Chinese iron ore imports have managed to compensate for the decline in coal volumes, supporting dry bulk freight rates,

…says Peter Sand, BIMCO’s Chief Shipping Analyst.

The vast majority of coal imported by China arrives by sea, primarily from Indonesia and Australia as the largest suppliers by far.

In recent years, shipping has become particularly vulnerable to geopolitics and the tensions between Australia and China are now in the spotlight. So far, coal imports have yet to see any major impact, but if the relationship between the two continues to deteriorate, ship owners may see a boost in tonne miles if China replaces Australian coal with coal sourced from more distant countries,

…explains Mr. Sand.

Chinese coal output has seen a slight decrease of -0.1% in the first eight months of 2020, totaling 2.45 billion tonnes.

Combined with the low imported volumes, the state of recovery for the Chinese economy looks unclear.