Shipping company Maersk released its trade report for 2018, according to which both US’s and Canada’s trades will continue to increase, but Canada is expected to surpass the US during 2018.

North American trade is expected to further increase. US and Canada will benefit from an expected increase of more than 3% in global trade volumes this year as US consumers support imports and Canadians gain from the signing of a free trade agreement covering a US$12.6 trillion market.

However, the US and Canada follow two different paths. For the US, gains will come from retail, chemicals, consumer electronics and grains sectors. However, the US is facing a trucking crisis, rail infrastructure needs to be updated while digital transformation pressures. The outlook is more positive for Canada, which can be one of the fastest growing markets in terms of container trade across the Americas in 2018.

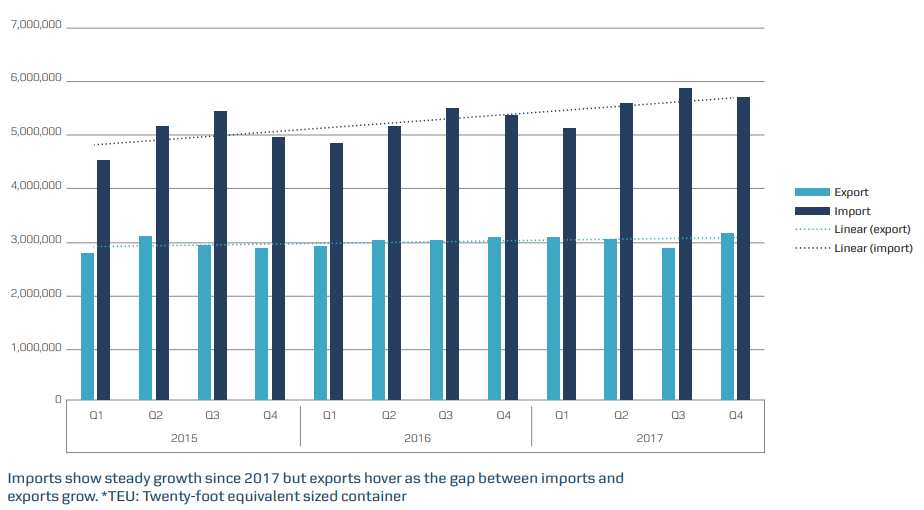

Last year, US’s maritime container imports and exports grew 4.7%, up from 3.9% in 2016, while Canadian total imports and exports increased to 6.9%, up from 1.4% in 2016. The US accounts for 24% of all global container trade, which moves more than US$4 trillion worth of goods a year.

Omar Shamsie, President for Maersk Line North America stated:

The US and Canada are growing and yet they are in two very distinct moments. The US is in digital disruption and transformation, putting pressure on the way the nation trades, so much so that the end-goal must change so that booking a container and moving it across continents becomes as easy as posting a parcel, helping US business flourish locally and globally. It sounds far-fetched when you consider how the industry does business now, but the future of the whole supply chain needs to be discussed at the highest levels, US competitiveness needs to come under a magnifying glass so the whole industry and authorities can address new ways of narrowing the ever increasing gap with imports and update itself in the face of digital disruption and increasing competition from Asia, Latin America and Europe.

For more information regarding Maersk’s report, please click in the PDF herebelow