BIMCO has released the Shipping Overview & Outlook for the first quarter of 2023 (Q1) including key highlights of container, tanker and bulk markets.

According to Niels Rasmussen, Chief Shipping Analyst, BIMCO, the following highlights are the most crucial for each market:

Container Market

Q1 2023 Demand recovery from second half of 2023 but supply grows significantly faster

Highlights

- Significant weakening of the underlying supply/demand balance with more downsides than upsides.

- Freight rates, time charter rates, and second-ship values all under pressure throughout 2023 and 2024

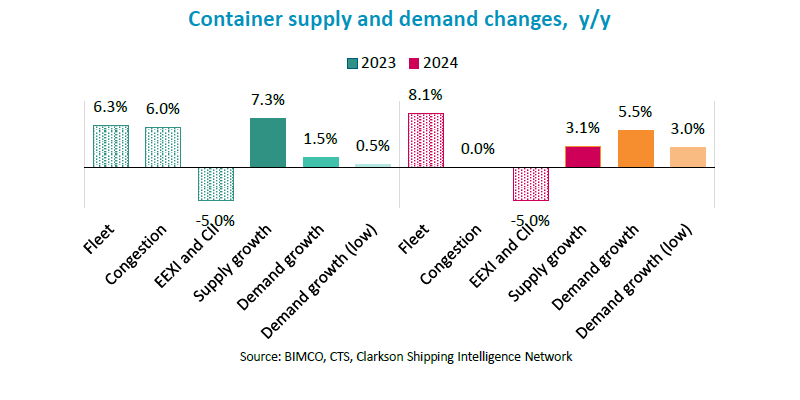

- Head-haul and regional trade demand growth of 1-2% in 2023 followed by 5-6% in 2024. Negative y/y growth through the first half of 2023 but return to growth thereafter.

- Risks remain and in our downside scenario we instead estimate growth of 0-1% and 2.5-3.5% in respectively 2023 and 2024.

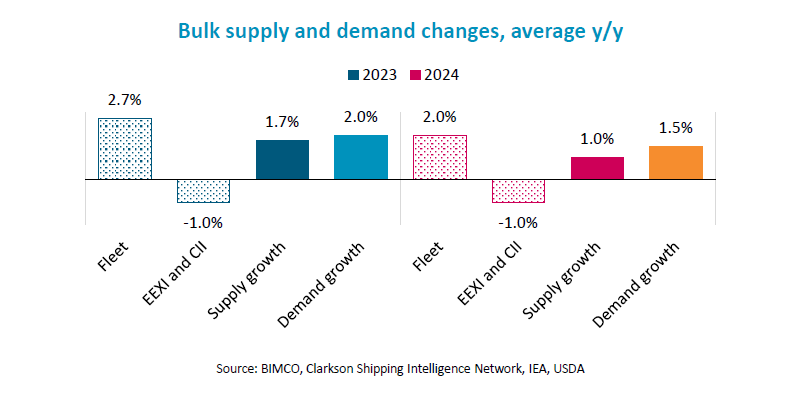

- Fleet growth of 6.3% and 8.1% in 2023 and 2024 respectively, while changes in congestion and sailing speed lead supply growth to outpace fleet growth in 2023 but will trail fleet growth in 2024.

- The IMF predicts global GDP growth of 2.9% in 2023 and 3.1% in 2024 but highlights that the balance of risks remains weighted on the downside.

- So far, liner operators have not been able to adjust capacity offered in line with demand and it is unclear whether the released 2023 service plans sufficiently address this imbalance.

- While average sailing speed has decreased following the reduction in congestion there is so far no evidence of the structural shift downwards due to EEXI/CII that had been previously indicated by major liner operators. We therefore predict that changes will be gradually phased in during 2023 and 2024.

EXPLORE MORE about the container market here

Tanker Market

The stars align to create the strongest market in 15 years

Highlights

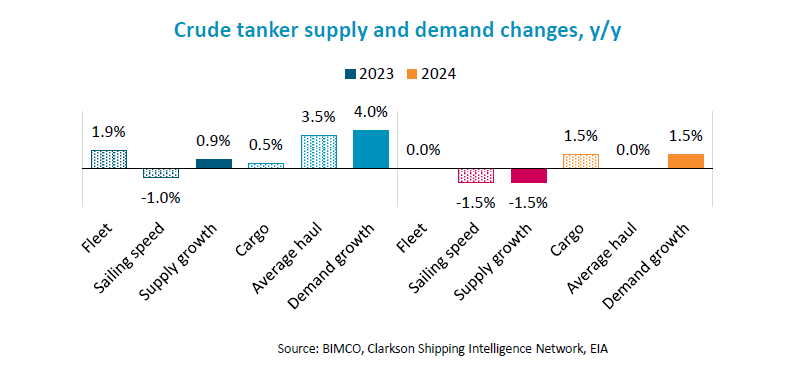

- Demand will grow faster than supply during both 2023 and 2024.

- In 2024, we predict that crude tanker demand will be up 4.5-6.5% on 2022, whereas supply will reduce by 0.6%. Similarly, we envisage product tanker demand growth of 6-8%, with supply falling 0.7%.

- Freight rates, time charter rates, and second-ship values will all see gains throughout 2023 and 2024.

- Renewed growth in China and increased demand for jet fuel following the reopening of travel to and from China are key drivers of cargo demand growth.

In addition, we expect that an increase of 3-4% in average sailing distances following the EU’s ban on Russian oil and oil products will add to tonne miles demand. - Fleet growth is limited by very small order books. Combined with predicted reduction in sailing speeds of 2-3% % due to decarbonisation regulations, overall supply will fall.

- The EIA predicts that oil prices with fall throughout 2023 and 2024 and that Brent will dip below USD 80/barrel in 2024.

- The IMF predicts global GDP growth of 2.9% in 2023 and 3.1% in 2024 but highlights that the balance of risks remains weighted on the downside.

- Risks to our forecast therefore remain. Cargo demand would suffer from lower economic growth and predicted structural shifts have yet to be seen.

EXPole more about the tanker market here

Bulk Market

The way China goes, so goes the market

Highlights

- We expect demand growth within the 1.5-2.5% range in 2023, driven by China’s economic recovery. Improvements in consumer sentiment should help solve the country’s real estate crisis and boost bulk demand.

- However, demand growth could weaken to 1-2% in 2024 due to an expected reduction in coal shipments. Import demand should fall as India and China continue to boost domestic mining and Europe transitions away from fossil fuels.

- The International Monetary Fund (IMF) estimates global economic growth of 2.9% in 2023 and 3.1% in 2024. The Chinese economy is now estimated to grow by 5.2% in 2023, a 0.8 percentage point increase over the IMF’s previous forecast.

- The dry bulk fleet is forecast to grow by 2.7% in 2023 and by 2.0% in 2024. Deliveries remain limited amid a small orderbook at 7.5% of the fleet.

- Supply is estimated to grow by 0.5-1.5% less than the fleet in 2023 and 2024 due to lower speeds caused by compliance with EEXI and CII regulations.

The supply/demand balance should improve in 2023, although risks will remain in 2024. We expect rates to start recovering as demand picks up in China. - Capesizes should benefit from a recovery in iron ore demand, while panamax ships are most exposed to a drop in coal shipments.