In this week’s “Shipping Number of the Week” from BIMCO, Chief Shipping Analyst, Niels Rasmussen, examines the global crude tanker markets which have continued to reshape in 2023.

In 2022, sanctions shifted Russia’s exports from Europe to Asia while OPEC production cuts in 2023 increased the Americas’ share of exports.

Driven by Increased production in Brazil, US, Guyana, and Canada, the Americas region is expected to produce 1.4 mbpd more oil in 2024 whereas global production is expected to increase only 1.3 mbpd. The whole region is therefore expected to follow Brazil’s development; more exports, longer voyages, and a greater share of the global crude tanker market.

…says Rasmussen.

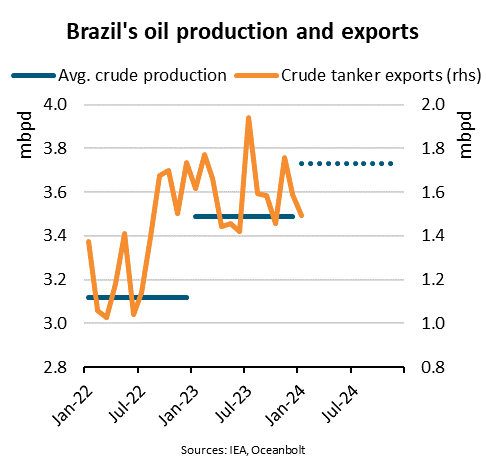

The reshaping of global crude tanker markets continued in 2023. In 2022, sanctions shifted Russia’s exports from Europe to Asia while OPEC production cuts in 2023 increased the Americas’ share of exports. Brazil’s oil production increased by 12% year-on-year in 2023 while crude tanker exports rose 19%.

..says Niels Rasmussen, Chief Shipping Analyst at BIMCO.

According to the International Energy Agency (IEA), Brazil’s oil production reached 3.49 million barrels per day (mbpd) in 2023, up from 3.12 mbpd the year before. Crude tanker exports increased from 1.35 mbpd in 2022 to 1.61 mbpd in 2023, and the country’s share of crude tanker exports thereby grew from 3.5% to 4.1% in 2022 and 2023 respectively.

“Brazil’s crude tanker exports to China grew 55% year-on-year from 0.41 mbpd in 2022 to 0.64 mbpd in 2023, accounting for 88% of the increase in Brazil’s crude tanker exports overall. The increased buying from Brazil also contributed nearly 30% of the 12% increase in Chinese crude tanker imports in 2023,” says Rasmussen.

The increased share of volume exported to China contributed to an increase of 4% in the average sailing distance for Brazil’s exports. Brazil therefore contributed 23% more tonne miles to crude tanker demand in 2023 than in 2022 equal to 5.8% of global tonne miles demand.

The shift in the destinations for Brazil’s exports also resulted in a shift between ship segments. VLCCs benefitted from the longer voyages and Brazil’s VLCC volumes and tonne miles increased respectively 49% and 44% over 2022.

The IEA expects Brazil’s oil production to increase by 0.24 mbpd in 2024. As refinery capacity and refinery runs are expected to remain static, they expect that the country’s crude tanker exports could grow by up to 15% in 2024.

China is expected to be the country with the biggest increase in oil demand in 2024. They can therefore expect that tonne miles for Brazil’s crude tanker exports will again grow faster than volumes and that VLCCs will benefit the most.

Driven by increased production in Brazil, US, Guyana, and Canada, the Americas region is expected to produce 1.4 mbpd more oil in 2024 whereas global production is expected to increase only 1.3 mbpd. The whole region is therefore expected to follow Brazil’s development; more exports, longer voyages, and a greater share of the global crude tanker market.

…says Rasmussen.