According to ABS, carbon capture, utilization, storage and transportation (CCUST) is one of the top priorities of the sustainability agenda, while onboard carbon capture systems gain ground in the shipping industry and are supported by regulations.

Capture

In their View of the Emerging Energy Value Chains report, ABS explains that in carbon capture, utilization and storage (CCUS) from point sources, CO2 is captured from large industrial sources, including power generation or industrial facilities (e.g., cement, steel factories, etc.). Different methods and technologies are considered for this purpose such as post- and pre- combustion and oxy-fuel combustion.

Direct air capture (DAC) is an emerging technology that captures CO2 directly from the ambient air rather than from specific emission sources.

Transportation

Once CO2 is captured, it needs to be transported from the capture site to either the storage or utilization sites. Transportation methods include pipelines, ships or other means, depending on the quantity of CO2 and the distance. CO2 transport is the vital link in enabling the deployment of CCUS.

Utilization

CO2 is utilized in a variety of industries, such as in the production of foods and beverages, as well as integrating it into industrial processes to convert it into fuels, chemicals or building materials while offering economic and environmental benefits.

Additionally, CO2 will be a key enabler in energy chains of the future as it be used to synthesize methanol, and then re-capture the CO2 from burning the methanol. Figure 3.3 provides an overview of the different uses of CO2. Based on the current market conditions, CO2 utilization occupies a small portion of the overall CO2 volume expected to be captured, making storage an important option.

Storage

There are a few options available for the permanent storage of CO2. One option includes using it during enhanced oil recovery (EOR), where it is permanently stored, following the recovery of oil from the reservoir.

This same process can be replicated by injecting supercritical CO2 into depleted oil and gas reservoirs, saline aquifers and other geologic formations. These have existed for millions of years and already have containment caps, faults and permeability features that are suitable for storing liquids.

One challenge that this process faces is that the CO2 stream needs to have consistent properties, and monitoring will be required to account for carbon to ensure there aren’t issues with long-term leakage.

Market status

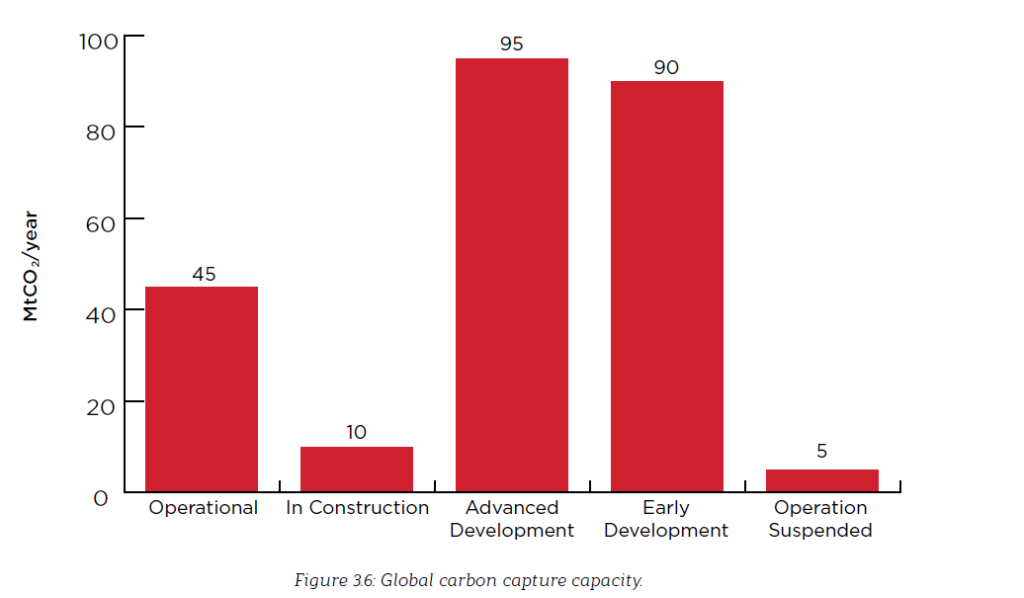

Based on the 2022 Status Report from the Global CCS Institute, there are over 190 facilities in the global project pipeline; CCS has progressively become commercially competitive in many countries with governmental policy and funding support.

As of September 2022, the total output capacity of CCS projects in development was 244 million tonnes per annum (Mtpa) of CO2, which represents a 44 percent increase over the past 12 months.

The deployment of other utilization routes remains limited. Only a few large-scale capture projects are targeting the use of CO2 to produce building materials or yield enhancement. However, there are several facilities that exist on a smaller scale to produce CO2-based chemicals and polymers. Some examples are as follows:

- Since 2015, approximately 75,000 tonnes of CO2 per year have been captured from a Capitol Aggregates Cement plant located in Texas. It has then been used for chemical production by the company Skyonic.

- In 2022, U.S. company Twelve announced the scale-up of their technology for electrochemical reduction of CO2 into various products that range from plastics to fuels.

- Econic Technologies announced partnerships with chemical companies in China and India to scale up their CO2 to polymers technology.

Furthermore, there have been recent government funding calls for CCUS hub developments in Canada, Europe and the U.S. to address industrial emissions and accelerate the development of both carbon-removal technology and infrastructure. There are approximately 15 CCUS hubs globally under various stages of development, with many more being planned. Countries and regions making notable progress in CCUS include:

- U.S.: In 2022, the U.S. announced significant opportunities aimed at accelerating the development of CCUS projects. One of the opportunities is the new funding under the 2021 Infrastructure Investment and Jobs Act, and favorable CCUS tax credits changes in the 2022 Inflation Reduction Act.

- EU: In March 2023, the EU introduced the Net Zero Industry Act, which proposes ambitious measures to achieve carbon neutrality. This includes setting an annual CO2 injection target of 50 Mt of CO2 by 2030 and improving permitting procedures for CCUS projects. At the same time, the pilot phase of Project Greensand in Denmark became operational. This project facilitates the transportation of CO2 from Belgium and its storage in a depleted oil field located in the Danish North Sea.

- The U.K. announced 20 bbillion (B) British Pound (GBP) in its Spring Budget for the early deployment of CCUS projects.

- Indonesia: In March 2023, Indonesia finalized its legal and regulatory framework for CCUS, making it the first country in the region to establish a framework for CCUS activities.

- In China, three new projects became operational in 2023 while Japan selected seven candidate projects for support towards their commercialization.