The market for work-class ROVs (WROVs) is on the increase again as the oil and gas industry is now exiting a cyclical downturn and entering a period of recovery, according to Westwood energy consultancy. Cost efficiency remains critical and drives the need for modern systems that can maximise uptime. Demand for both traditional oil and gas applications and new offshore support roles will support a recovery in demand over the 2019-2023 forecast.

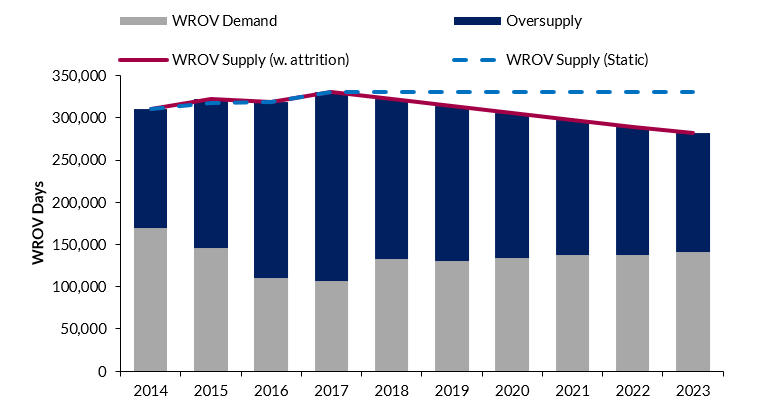

Westwood estimates 2017 global utilisation reached a low of 32%, down from 55% in 2014. Top-tier ROV operators Oceaneering and Helix Energy Solutions quoted 2017 utilisation of 46%, and 42% respectively.

Over the forecast, the oversupply situation will ease, with utilisation levels expected to return to 50% by 2023. Whilst stable demand growth is forecast (2% CAGR), ROV expenditure is constrained at present by a slow recovery in day rates in what remains a ‘buyers market’. As utilisation improves, ROV operators can expect to see commercial terms moving in their favour.

Key Conclusions

- WROV utilisation to recover from 2017 lows, but not expected to reach pre-downturn levels. Oversupplied market to be eased over the forecast.

Global ROV demand to total 680,917 days over 2019-2023, growing at a 4% CAGR off the back of improved market conditions. Expenditure to total $6.9bn over the forecast. - Drilling support to be largest ROV market accounting for 40% of total expenditure, growing at 6% CAGR. The sector will lead by Latin America with activity in Brazil, Guyana and the Falkland Islands bolstering demand.

- IMR support demand to increase 11% and expenditure to total $2.2bn over forecast, driven by an ageing installed base of infrastructure.

Increased autonomy remains a goal for ROVs, with operations aimed at requiring less manned intervention. - Subsea resident ROVs (RROVs) remain a long-term goal for oil & gas operators, as developments are sanctioned in ever more challenging and remote locations.