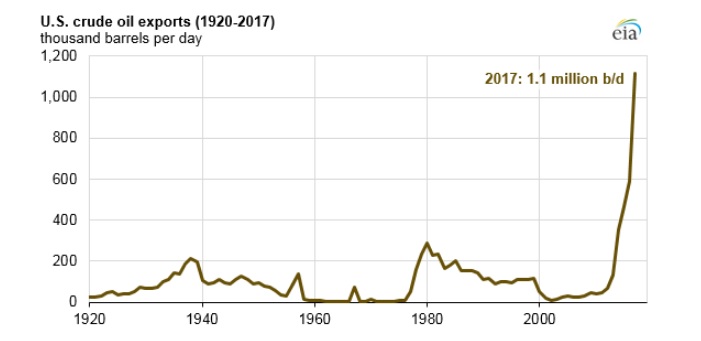

US crude oil exports grew to an average of 1.1 million barrels per day (b/d) in 2017, the second full year since restrictions on crude oil exports were removed. Crude oil exports in 2017 almost doubled in 2016, supported by increasing domestic crude oil production and expanded infrastructure, according to EIA.

Highlights

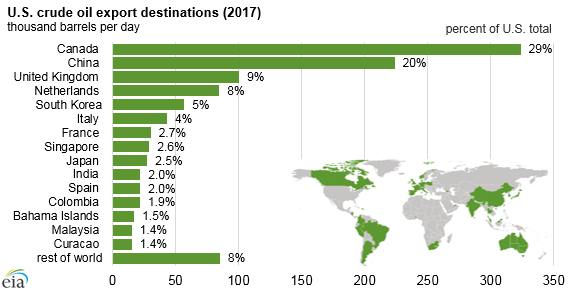

- US crude oil exports went to 37 destinations in 2017, compared with 27 destinations in 2016.

- Similar to previous years, Canada remained the largest destination for US crude oil exports, but Canada’s share of total US crude oil exports continued to decrease, down from 61% in 2016 to 29% in 2017.

- US crude oil exports to China accounted for 202,000 b/d (20%) of the 527,000 b/d total increase. China surpassed the UK and the Netherlands to become the second-largest destination for US crude oil exports in 2017.

- Many European nations are among the largest destinations for US crude oil exports, including the United Kingdom, Netherlands, Italy, France, and Spain. India, which did not receive US crude oil exports in 2016, received 22,000 b/d in 2017, tying with Spain as the tenth-largest destination.

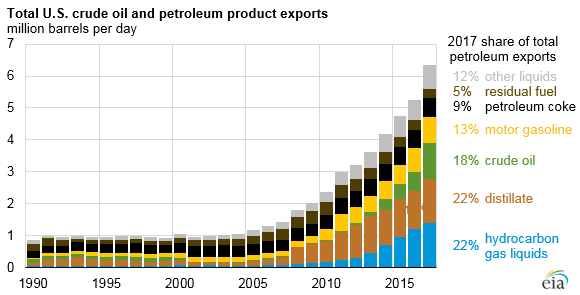

Crude oil now makes up 18% of total US petroleum exports, making it the third-largest petroleum export after hydrocarbon gas liquids (HGL) and distillate fuel. Before the restrictions on domestic crude oil exports were lifted in December 2015, most of the growth in US petroleum exports was petroleum products—mainly HGLs (such as propane), distillate fuel, and motor gasoline, EIA noted. Previously, crude oil’s largest share of total US petroleum exports was 13% in 1999, when total volumes of US petroleum exports were less than 1.0 million b/d, which was much lower than the 6.3 million b/d total in 2017.

Increasing production and expansions of US pipeline capacity and export infrastructure facilitated increased crude oil exports. As explained, several new or expanded pipelines came online in 2017 to move crude oil from producing regions, primarily the Permian basin of Texas and New Mexico, to the US Gulf Coast. On the US Gulf Coast, recently expanded crude oil export infrastructure in ports such as Corpus Christi and Houston, Texas, and in ports along the Mississippi River in Louisiana allowed larger volumes of crude oil exports.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

A larger discount of domestic crude oil prices, represented by West Texas Intermediate (WTI) crude oil, to international crude oil prices, represented by Brent, reflects these dynamics. Spot Brent crude oil prices averaged $3.36 per barrel (b) more than WTI prices in 2017 compared with just $0.40/b more in 2016, providing a price incentive to export US crude oil into the international market.

Similar production, infrastructure, and price conditions will be necessary for US crude oil exports to continue increasing. EIA’s March Short-Term Energy Outlook forecasts US crude oil production to increase by 1.4 million b/d in 2018 and the Brent-WTI spread to average $3.96/b