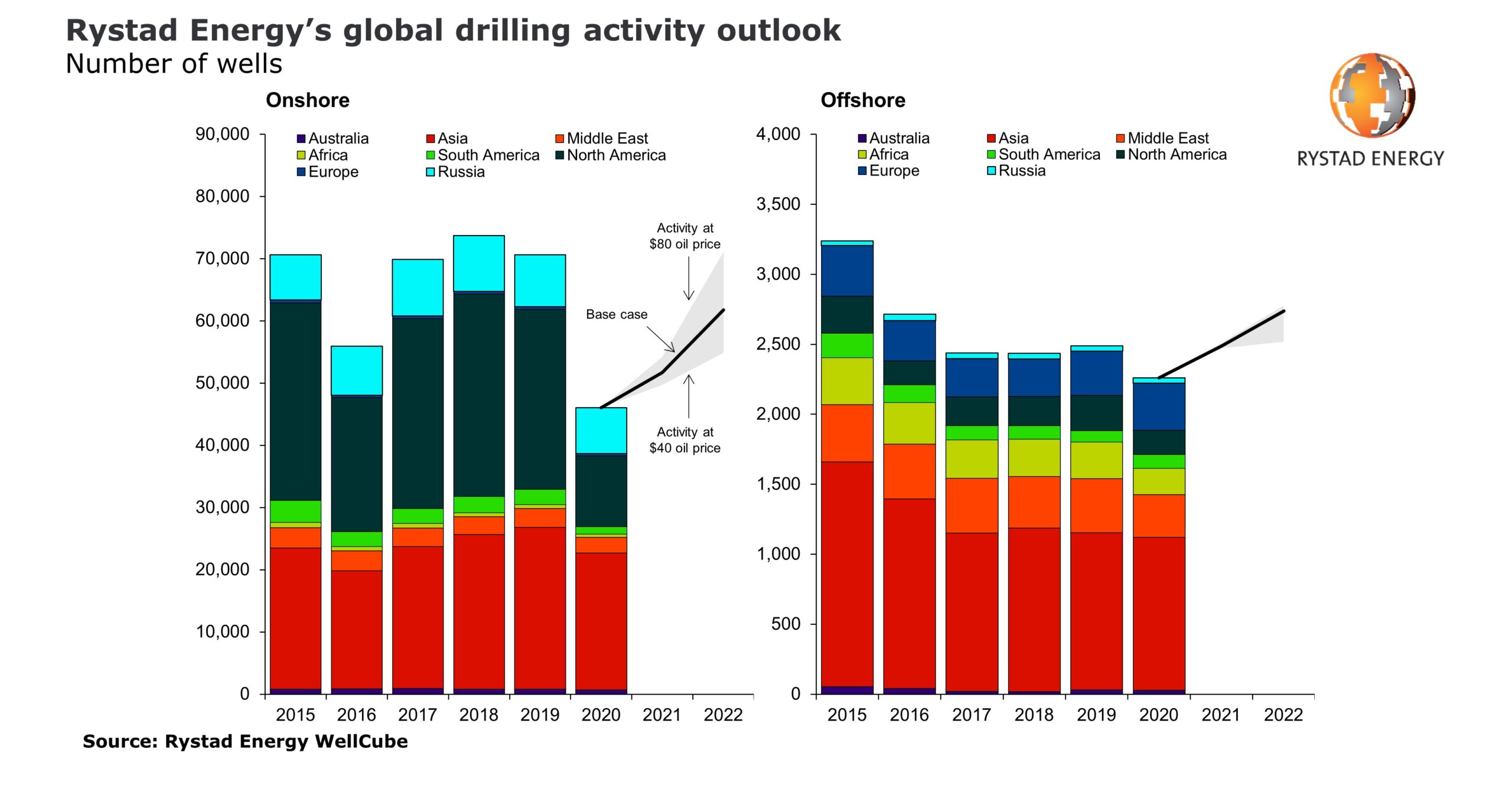

Supported by vaccination efforts and OPEC+ supply cuts, oil and gas demand recovery is proving good for drilling activity after a challenging 2020. In this respect, Rystad Energy expects around 54,000 wells to be drilled worldwide in 2021, a 12% increase from 2020 levels.

In 2022, drilling is set to increase even more, by another 19% year-on-year to about 64,500 wells, though activity will still fall short of the 73,000 wells drilled in 2019.

Specifically, in the offshore segment, Rystad expects drilling activity to increase year-on-year by about 10% in both 2021 and 2022.

This will bring the number of offshore wells drilled to nearly 2,500 this year, from less than 2,300 in 2020, and we forecast that the corresponding number for 2022 will surpass 2,700,

…says Rystad.

Such a healthy recovery is in fact poised to propel offshore drilling activity beyond pre-pandemic levels during the next two years, as the number of offshore wells drilled globally in 2019 was just shy of 2,500. This means the recovery of offshore drilling will already happen in 2021, with 2022 being a year of further growth.

In contrast to previous years, when the North American shale sector-led production growth, we expect the onshore and offshore shelf in the Middle East and the deepwater market in South America to be the main drivers of growth going forward. To recover production levels, operators will have to launch new drilling plans in tandem with maintenance and enhancement programs for existing wells, opening significant opportunities for well service suppliers in the years ahead,

…explains Daniel Holmedal, energy research analyst at Rystad Energy.

For offshore drilling activity, the deepwater markets in Europe and Africa are expected to remain relatively stagnant compared to other top regions in 2021.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

In Europe, this comes after a strong year of activity in 2020, driven by high project sanctioning activity from 2017 through 2019. Most of the deepwater growth comes from North and South America, where Brazil, Guyana and Mexico are the most prominent drivers of the upswing.

On the well intervention side, West Africa and the Middle East could provide a strong market in the coming years with a total of around 10,000 active offshore wells on oil fields, with an average well age of 16 and 21 years, respectively. In comparison, most other regions have an average well age of between 10 and 15 years.