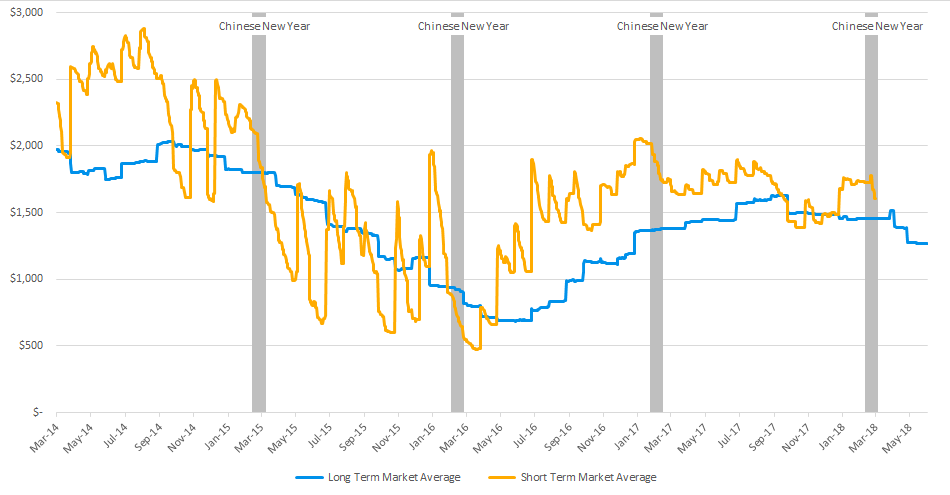

As the Chinese New Year took place a while ago, the year of the Dog may affect container rates in the coming months. Even though the Chinese New Year was somewhat later in 2018 compared to 2017, the increase is similar to what the market reported last year.

Xeneta reports that afet Chinese New Year, rates on the key Far East – North Europe trade maintained their upwards momentum. The market average increased from $1,487 FEU on 1st December 17 to $1,726 FEU on 16th February 18, representing an increase of 16.1%. Rate growth could have been even higher if carriers were more successful in fully implementing their desired minimum FAK rate on the route of around $1,900-$2,000 FEU.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

Even though carriers are known to increase rates following Chinese New Year, they are very rarely maintained. For example, in 2017 carriers did not maintain the positive rate environment once New Year celebrations had come to an end. In 2016 a similar trend was also reported, as carriers lost even more ground post Chinese New Year.

Considering the monthly average rate on the Far East – North Europe trade, volatility has reduced from an average month-on-month change of 28.4% in 2016 to 5.8% in 2017, which will be seen as a positive from a carrier cash flow perspective. This many suggest that rates are less likely to immediately rebound following any declines.

Furthermore, the market average FAK rate has decreased from $1,726 FEU to $1,606 FEU as of 6th March 18, a fall of 7.0%. Over the equivalent post Chinese New Year period of 2017, rates declined from $2,018 FEU on 28th January 17 to $1,714 on the 15th Februart 17, a decline of 13.0%.

This decline in FAK rates may indicate that those seeking comparative “value” from their long term contracts effective from the second quarter of 2018, are starting to achieve heavier discounts compared to those secured in the first quarter of 2018.

However, if long term contracts and FAK rates become more closely aligned, then further discounts to spot rates could happen.