According to Moore Stephens shipping confidence reduced slightly in the three months to end-November 2018. Namely, the average confidence level expressed by respondents was 6.0 out of of 10.0, in comparison to the 6.3 recorded in August 2018.

Confidence on all main categories was less, except for brokers, where the rating increased from 4.9 to 5.2. Owners’ confidence decreased to 6.4 from 6.8, which was the second highest achieved by this category of respondent in the life of the survey.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

The confidence rating for managers, meanwhile, was 6.0 from 6.2 and that for charterers from 7.0 to 6.8. The survey started in May 2008 with an overall rating for all respondents of 6.8 out of 10.0.

Confidence was also down in Europe, from 6.2 to 6.1, and in North America, from 6.8 to 5.2, but remained steady in Asia at 6.3.

What is more, the possibility for major investments over the next 12 months was the same at 5.5 out of a maximum score of 10.0. Owners’ confidence was down from 6.5 to 6.3, but that for charterers increased from 4.0 to 6.6. Expectations of major investments were more in Asia from 6.1 to 6.2, but less in Europe from 5.3 to 5.2.

Moreover, respondents who expected finance costs to be more over the coming year was up from 59% to 67%. The figure for owners reached 71% from 70%, while charterers and managers were up from 50% to 80%, and from 45% to 63% respectively. As far as brokers are concerned, their situation remained unchanged at 71%.

Additionally, 21% identified that competition overtook demand trends (20%) as the factor most likely to impact performance most significantly over the next year, with finance costs with 16%, coming in third place.

Furthermore, respondents expecting higher freight rates over the next 12 months in the tanker market increased to 60%, while those expecting lower rates increased to 12%.

As for the dry bulk sector, expectations of rate increases were the same at 38%, along with a 4% increase to 15% in the numbers expecting lower rates. Those anticipating higher container ship rates decreased by 1% to 25%. In addition, net freight rate sentiment in the tanker sector was +48, in dry bulk +23, and container ships +1.

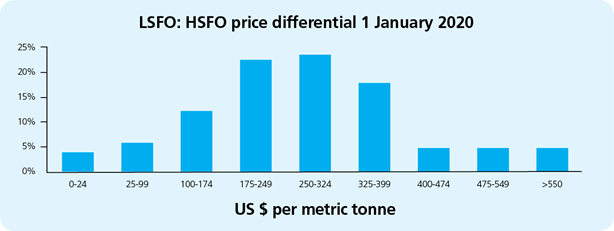

Another interesting fact according to Moore Stephens, is the fact that 24% of respondents expect the price differential between high-sulphur fuel oil and IMO-compliant low-sulphur fuel oil at 1 January 2020 to be between $250 and $324 per metric tonne. In this regard, 23% believe the figure will be between $175 and $249, and 18% between $325 and $399. However, 12% expect the cost differential to be between $100 and $174.

Commenting on the results of the survey, Richard Greiner, Moore Stephens Partner, Shipping & Transport, stated:

It is disappointing to close the year with a small downward tick in confidence. But shipping is nothing if not volatile, and there will always be ups and downs. We should not forget, either, that it was in 2018 that confidence reached a four-year high