Oil and gas sales value in Scotland has risen by 18.2% between 2016-17 and 2017-18, according to the Oil and Gas Production Statistics 2017-18, released by the Scottish government. The figures also show that despite the slight decrease of 1.7% in the latest year, production of oil and gas remains 23.1% higher than the level recorded in 2014-15.

Key findings

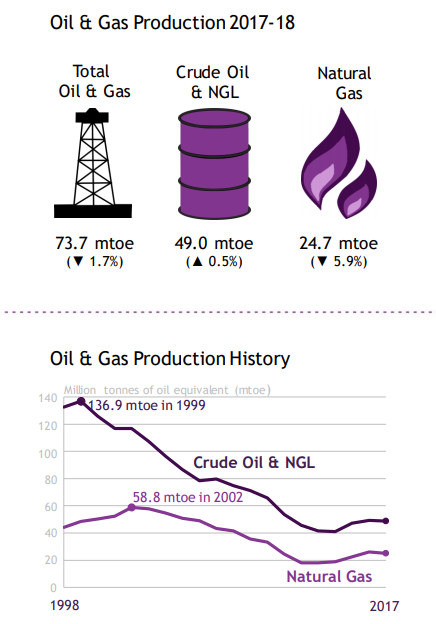

- Production of crude oil and natural gas liquid production (NGL) was fractionally up over the year, increasing by 0.5%.

- Scotland’s share of production accounted for 96% of total UK crude oil and NGL output, while overall Scottish oil and gas production was 81% of the UK total.In financial year 2017-18, oil and gas production in Scotland (including Scottish adjacent waters) is estimated to have been 73.7 million tonnes of oil equivalent (mtoe).

- Production in Scotland decreased by 1.7% compared to 2016-17, and accounted for 81 per cent of the UK total (down from 82 per cent in 2016-17).

- In 2017-18, oil and gas fields in Scotland accounted for 96 per cent of UK crude oil and natural gas liquids (NGL) production, and 63% of UK natural gas production.

- In 2017-18, the approximate sales value of oil and gas produced in Scotland is estimated to be £20.0 billion

- The approximate sales value increased by 18.2% compared to 2016-17, despite the slight decrease in production, due to continued increase in prices throughout 2017 and the beginning of 2018.

- In 2017-18, operating expenditure (excluding decommissioning) on oil and gas production in Scotland is estimated to be £6.2 billion, up from £5.3 billion in 2016-17.

- In 2017-18, capital expenditure on oil and gas production in Scottish waters is estimated to be £5.8 billion, down from £7.8 billion in financial year 2016-17.

Minister for Energy, Connectivity and the Islands, Paul Wheelhouse, said:

At the same time the industry faces continuing challenges, including issues around exploration, and the Scottish Government will continue to do what we can to support the sector. However, the UK Government retains most of the key policy levers affecting the offshore sector, so we will continue to argue they should bring forward measures to rebuild exploration activity and to maximise economic recovery, while also providing an immediate boost to the supply chain.”