The Port of Corpus Christi, which is US’s largest oil export port will attempt to raise $300 million, in order to conduct work which will make the Port ready to handle the US shale export increase.

Namely, as Reuters reported, the Port of Corpus Christi Commission will vote on a plan to raise the debt next month through underwriters led by Wells Fargo & Co, Citigroup Inc and JPMorgan Chase & Co. A decision to raise fees for dredging, which could begin as of September, would be a rare move among US Gulf Coast ports.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

During 2018, the Port of Corpus Christi has already received $36 million on an expansion project that will make the Port able to accommodate tankers with capacity of 1 million barrels of oil.

As Wood Mackenzie has reported, the Port’s oil export capacity will probably increase to 3.3 million bpd by 2021 from 1.3 million bpd this year, keeping it as the top oil export port.

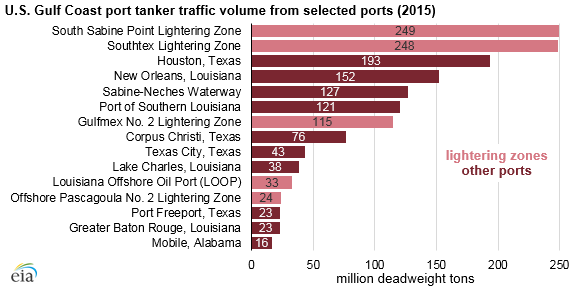

International buyers are currently asking for more US crude. However, they are not getting it due to infrastructure limitations in the US Gulf Coast ports. These terminals have been designed for imports only recently, and are now trying to adapt their operations in order to handle exports, including accepting larger tankers.

The US is now exporting more than 2 million barrels of oil a day, but the largest tankers that are currently sailing, choose only the Louisiana offshore port, as the others are not deep enough.

Because of their large size, VLCCs require ports with waterways of sufficient width and depth for safe navigation. All onshore US ports in the Gulf Coast that trade petroleum are located in inland harbors and are connected to the open ocean through shipping channels or navigable rivers. Although these channels and rivers are regularly dredged, they are not deep enough for deep-draft vessels such as fully loaded VLCCs.

The inability to fully load larger and more cost-effective vessels affects prices for US crude oil exports. Using a number of smaller ships requires a wider price spread between US crude oil and international crude oil prices to balance the lower economies of scale and costs associated with reverse lightering and partial loadings.