NYK will issue its 47th unsecured corporate bonds (transition bonds) and 48th unsecured corporate bonds (green bonds) in the Japanese domestic market in early April.

This will be NYK’s second green bond issuance since May 2018 and third transition bond issuance since July 2023.

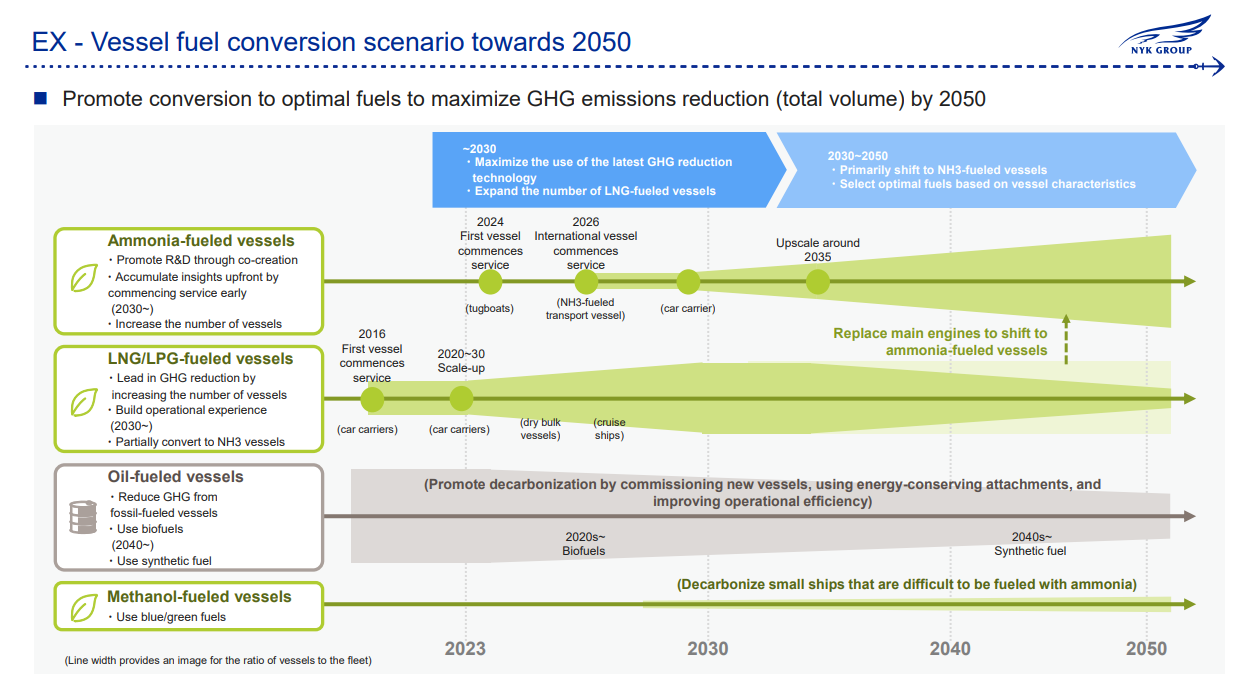

NYK will issue the bonds to accelerate ESG management advocated in the company’s medium-term management plan “Sail Green, Drive Transformations 2026 – A Passion for Planetary Wellbeing -“. NYK will use the funds raised by the transition bonds for projects aligned with the company’s long-term transition strategy toward decarbonization (transition projects), such as LNG-fueled vessels.

On the other hand, the funds generated by the green bonds will be used for projects that mitigate global warming (green projects), such as ammonia-fueled ammonia carriers to be built through the Green Innovation Fund.

NYK issued the shipping industry’s first green bonds in 2018 and Japan’s first transition bonds in 2021. The company will continue to promote ESG finance and aim to have its growth strategy based on ESG management.