Inmarsat published a new report pinpointing the impact of COVID-19 in accelerating global shipping’s digital journey.

The report ‘A Changed World: The state of digital transformation in a post-COVID-19 maritime industry’ captures a sector fast-tracking IoT-based solutions from November 2019. It also characterises COVID-19 as a “universal disruptor and catalyst for digital transformation”.

Increase in digitalization

The COVID-19 pandemic has led to a large increase in the adoption of digital tools across the industry. But there is more to digital transformation than adopting digital tools; genuine transformation is still some years away. There is zero doubt that COVID-19 has accelerated the process, average daily data consumption per vessel increased from 3.4 to 9.8 gigabytes between January 2020 and March 2021.

Digital solutions are now pervasive in maritime, and one consequence of COVID-19 has been that our customers – and their customers – increasingly think digital first

commented Stefano Poli, VP Business Development, Inmarsat Maritime.

The impact of COVID-19 on ship operations is evidenced by a massive increase in the use of remote services such as pilotage and surveying. Similarly, crew training and officers examinations went fully online for the first time ever in some jurisdictions.

2020 saw a small dip in spending growth on digital tools developed specifically for the maritime industry. However, overall there was significant investment in general IT infrastructure. Before the pandemic, global spending on digital products and services in the maritime sector was forecast to be $124bn in 2020.

The report estimates that the actual spend was $2bn lower, at $122bn. Pre-pandemic forecasts estimated that the digital maritime industry would be worth $135bn in 2021. But we estimate that the global maritime digital products and services market will turn over $159bn this year; An increase of $24bn or 18% on previous forecasts.

Based on this new data, we are forecasting that by 2022, industry turnover will be three years ahead of pre-pandemic growth forecasts

By 2030, we estimate the industry will be worth $345bn, up from a previous forecast of $279bn. Similar patterns are seen at a local level in the UK, with 2020 seeing spend reduced by c. £100m ($135m) and 2021 seeing a c. £1.0bn ($1.3bn) lift on pre-pandemic spending forecasts.

Investment patterns

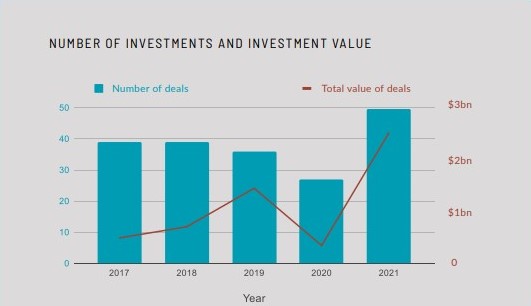

Venture investment patterns saw a similar, but more extreme, dip followed by a rapid recovery. Investment values fell from $1.4bn in 2019 to just $345m in 2020. Inmarsat estimate that by the end of 2021 a total of $2.5bn will have been invested with total deal flow up by 85% on 2020 levels, bringing the level back to pre-pandemic forecasts.

The UK maritime technology sector has weathered the pandemic well. The UK has produced more maritime

technology businesses in the ship operations and management sector than any other G7 nation since 2008 and the government has recently announced several measures to boost maritime innovation.

The UK is progressing well against the shortterm measures of the government’s Maritime 2050 strategy, particularly in areas such as technology, people, and trade. But the government lags behind its own targets on areas including the environment, infrastructure, and security.

Looking ahead, decarbonisation is the biggest long term issue facing the industry. Changing fuel infrastructure is a complex and lengthy process, as evidenced by the 97-year journey to remove tetraethyl lead as an additive in the petrol supply chain. But digital tools can play a strong role in the immediate future of the industry’s decarbonisation journey.

For example, there is evidence of fleet-wide fuel savings of up to 20% just from changing the handling behaviour of a ship’s bridge team

Although the industry has undergone a rapid shift in the last 18 months, there is no doubt that there is more to come. Efforts to decarbonise the maritime industry will need to eclipse the impact of the pandemic by a long way.

To facilitate this change, the authors recommend that industry stakeholders create a long term transformation plan, that government boosts non-financial support for innovation in the sector, and that innovators take the time to fully understand the various levels of market maturity before creating and launching new technology products.