During IUMI’s conference in Cape Town, Astrid Seltmann, Vice Chair of the IUMI Facts and Figures Committee gave updates on the macroeconomic environment and shipping market and the global marine insurance market.

Namely, the purpose of the committee is the production and publication of statistics during spring and autumn, which focus mostly on the trends of the maritime insurance.

Specifically, global economy is developing at an unprecedented rate and has reached its fastest pace during 2010-2018. Prices concerning commodities rarely increase, if at all. Yet, the general outlook is more positive in comparison to the past.

There is still an uncertainty because changes in trading policies, Brexit, financial uncertainties and ongoing conflicts in various parts of the world will influence the future macroeconomic development.

Moreover, Astrid Seltmann, Vice Chair of the IUMI Facts and Figures Committee and analyst/actuary of The Nordic Association of Marine Insurers, highlighted that the fleet growth globally is remaining stable and to this result, the average age fleet is increasing.

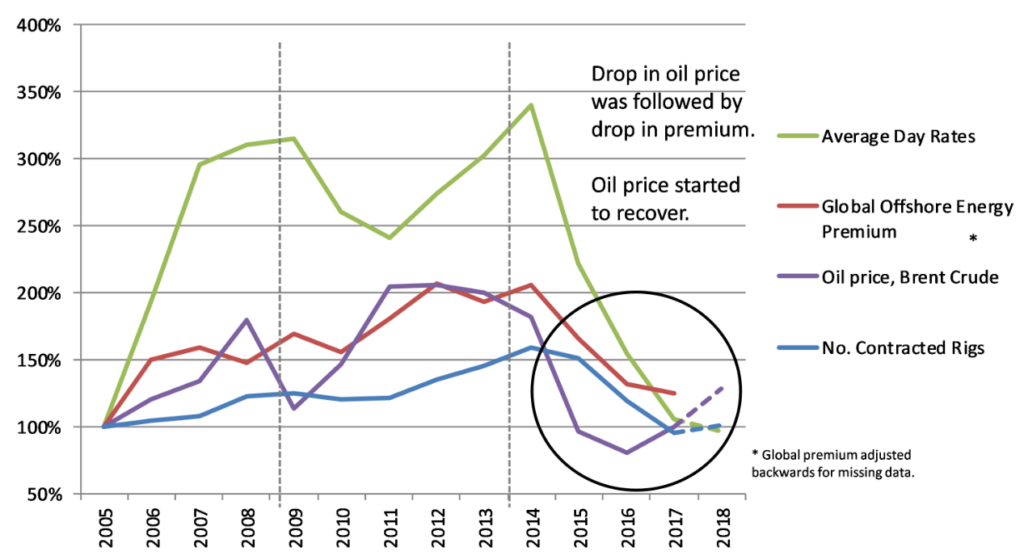

Ship earnings are enhancing, but are still competitive. Since the oil price started to rally in 2017, activity in the offshore sector has started to gain traction again.

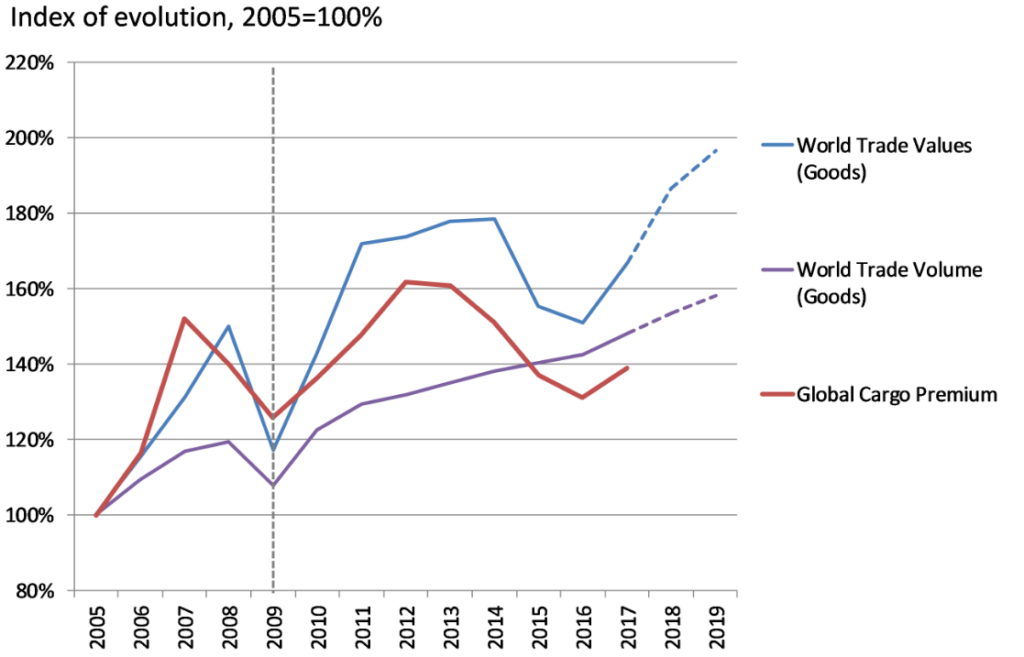

According to IUMI, similar to the 2017 statistics, cargo insurance results in recent years were heavily impacted by large event losses. Yet, global trade reached a 6% increase despite cargo difficulties. Increasing risk accumulation on single sites is a challenge which needs better monitoring, but also increasing expenses and coverage extensions are a concern.

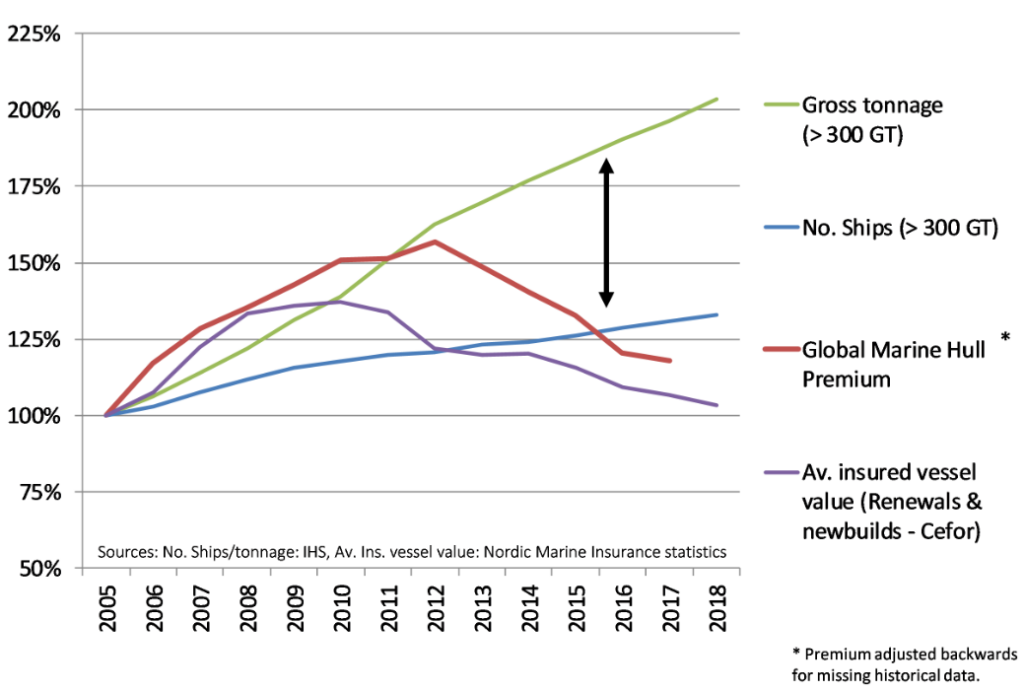

Also, the general hull premium decreased by 2.3% in 2017 but comparing the hull premium and average vessel values to the world fleet development shows an increasing mismatch between fleet growth and hull income.

This development is also reflected in the global hull insurance results, which continued to deteriorate substantially over the last three years. The only extraordinary claims impact on the 2017 results came from hurricane losses on yachts.

Moreover, after two years with more than a 20% decrease in the offshore premium, the decrease stabled out in 2017 after the oil price started to rally.

Despite the decrease, there is a positive outlook, according to IUMI, claiming potential arising from the reactivation of complex offshore units is a concern.

Concluding, as IUMI stated the market environment is improving in all fields. Yet, sustainability of results can only be maintained by a risk evaluation taking into account all risk aspects, such as scope of coverage, features of the covered risks, accumulation scenarios, climate change, new technology and the combined effect on expected claims costs.