This week, shipping container rates from East Asia and China to the US West Coast rose, reversing a trend that had seen rates fall by almost 36% since July, as late-season holiday demand emerged, according to Independent Commodity Intelligence Services (ICIS).

Many importers had pulled holiday volumes early to avoid potential issues related to a US East Coast dock workers strike scheduled to begin on 1 October. Judah Levine, head of research at online freight shipping marketplace and platform provider Freightos, indicated that front-loading of volumes to the East Coast in September may have been stronger than to the West Coast due to the rush to beat the 1 October strike deadline.

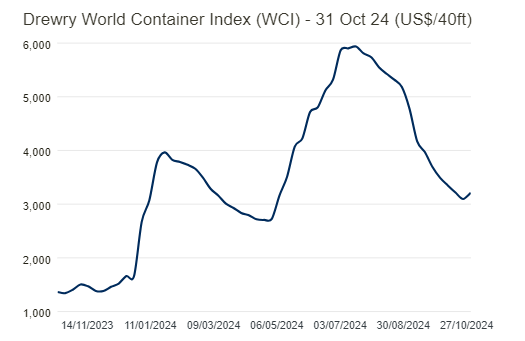

Supply chain advisors Drewry reported that Shanghai-USWC rates have edged higher by less than 1%. They anticipate this trend to continue as the Christmas rush intensifies. Drewry’s World Container Index has shown that average global rates are rising, as illustrated in the following chart.

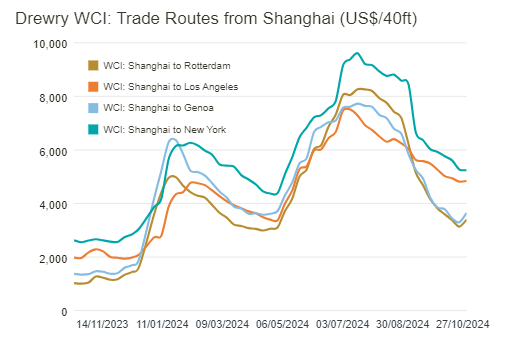

Rates from Shanghai to Europe rose more dramatically than those from Shanghai to the US, as highlighted in the following chart from Drewry.

Levine stated that the stronger front-loading of volumes to the East Coast could explain the sharper drop in East Coast rates over the past few weeks, as well as the anomaly that saw East Coast rates fall below West Coast rates. Typically, rates to the East Coast are about $1,000/FEU (40-foot equivalent units) higher than those to the West Coast. Drewry continues to observe that East Coast rates remain about $400/FEU higher than West Coast rates. Levine emphasized that rates to both coasts are still $1,000-1,500/FEU above their April lows.

Container ships and costs relevant to the chemical industry

The significance of container ships and shipping costs for the chemical industry is underscored by ICIS. While most chemicals are liquids shipped in tankers, container ships transport polymers such as polyethylene (PE) and polypropylene (PP) in pellet form. They also carry liquid chemicals in isotanks.

East Coast labor update

Union dock workers and US East Coast port operators will resume negotiations on a new master agreement in November, according to a joint statement from both parties involved. The International Longshoremen’s Association (ILA), representing the dock workers, and the United States Maritime Alliance (USMX), which represents the ports, reached a tentative agreement on 3 October that ended a three-day strike. The strike was paused until 15 January after the parties agreed on the salary portion of the agreement, essentially meeting in the middle.

Levine noted that port automation remains a significant sticking point, and if no progress is made in the coming weeks, anxious shippers may start increasing orders again ahead of another possible strike.

Canada West Coast port labor unrest

According to ICIS, the British Columbia Maritime Employers Association (BCMEA), which represents ports on Canada’s west coast, has issued formal notice of its intention to lock out port workers coastwide, starting Monday, 4 November at 8:00 local time. On Canada’s east coast, dock workers at the Port of Montreal went on an indefinite strike at two of the port’s four container terminals on Thursday, 31 October.

The labor dispute involves automation at Dubai Ports World (Canada) and retirement benefits. The parties have been negotiating a new collective labor deal since the last one expired in March 2023.

Liquid chem tanker rates stable

In the latest reports, US chemical tanker freight rates were largely unchanged this week for most trade lanes, while vessel demand continues to be soft for various routes, as indicated by ICIS. The USG to ARA route remains soft and solid for contractual cargoes, and any additional available CPP tonnage could further pressure the market. A similar situation exists for volumes on the USG to the Caribbean and South America trade lanes.

From the USG to these regions, space among regular carriers remains available due to a lack of interest. However, for the USG to Asia, spot volumes continue to be weak as there appears to be ample prompt space available. Primarily parcels of methanol to China seem to provide some support to the weak market. Additionally, ethanol, glycols, and caustic soda have been observed in the market in various directions, ICIS concludes.