Eco ships will be able to bargain a considerable premium over older vessel ahead of high bunker prices, creating a two-tier market. After 2020, Drewry expects increased LSFO/ MGO prices, along with cheaper HFO prices. This will lead to a three-tier structure.

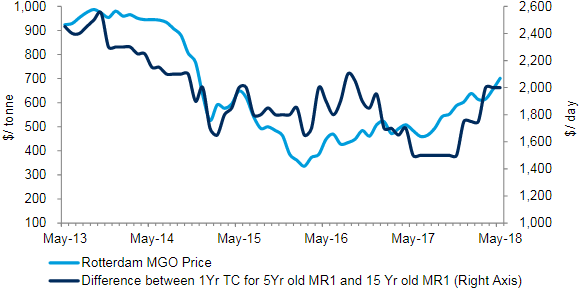

Engine efficiency plays a critical role in voyage costs, and its importance increases when bunker prices are high, as they currently are. The recent increase in bunker prices led to new MR tonnage able to bargain as high as $15,000pd, while older vessels are being fixed at $13,000pd and less.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

Drewry also expects a $76 per barrel price in the third and fourth quarters of 2018. Compared to past years, prices were $79 per barrel in November 2014, while the TC rate difference between a five-year and 15-year MR product tanker period rates was about $1,900pd.

With an increase in bunker prices, the period rate differential between modern and old tonnage will strengthen. What is more, as a result of the expected IMO regulations on the sulphur cap, vessels that do not have scrubbers will have to burn expensive MGO or LSFO fuel. Thus, the fuel savings on eco-ships will be further increased.

Savings will be reflected in high period rates, and Drewry notes that the period rate margin between eco and non-eco tankers to widen. Additionally, tankers with scrubbers will bargain a premium over eco-ships.