The International Chamber of Commerce (ICC) Banking Commission released its 2018 Trade Register report, highlighting once again the low risk nature of trade finance in comparison to other asset classes. This year’s report captures a full decade of trade finance-related data – containing over US$12 trillion of exposures from 24 million transactions across six products and 25 banks worldwide.

Key findings

- In 2018, global trade reached a new peak of US$18.5 trillion, underpinning a trade finance revenue pool of US$48 billion.

- ICC Trade Register data confirms default rates from 2008-2018 are low across all products and regions surveyed.

- For the first time, payables finance and non-OECD Export Credit Agency-backed export finance products are included in the Trade Register.

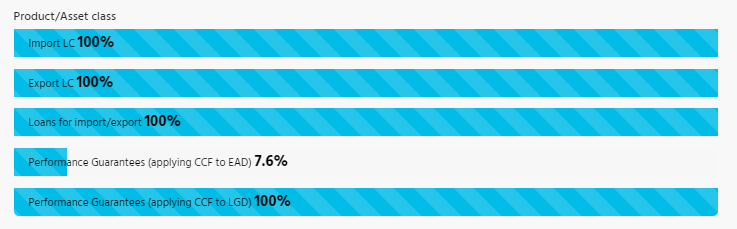

Results namely indicate that default rates from 2008-2018 are low across all products and regions, averaging 0.37% for Import Letters of Credit (L/Cs), 0.05% for Export L/Cs, 0.76% for Loans for Import/Export, and 0.47% for Performance Guarantees (when weighted by obligors).

The results extend the decline in risk seen in 2016 into 2017, likely driven by strong GDP growth and the general de-risking approach taken by banks with regards to their balance sheets.

This year’s data set also includes non-OECD Export Credit Agency-backed export finance and, given its growing and now longstanding significance across all markets, supply chain finance (SCF).

In its inaugural year, the SCF data set, while relatively small, provides initial indications that the probability of default for SCF is similar to other short-term trade finance products.

This year’s report reinforces the findings of previous years’ studies: trade finance products present banks with low levels of credit risk. This further supports the favourable treatment of trade finance as an asset class by the Basel Accords and increases the attractiveness of trade finance to banks, benefiting global trade and widening market access,

…says Daniel Schmand, Chair of the ICC Banking Commission.

The report was conducted with the support from both Global Credit Data (GCD) and Boston Consulting Group (BCG).