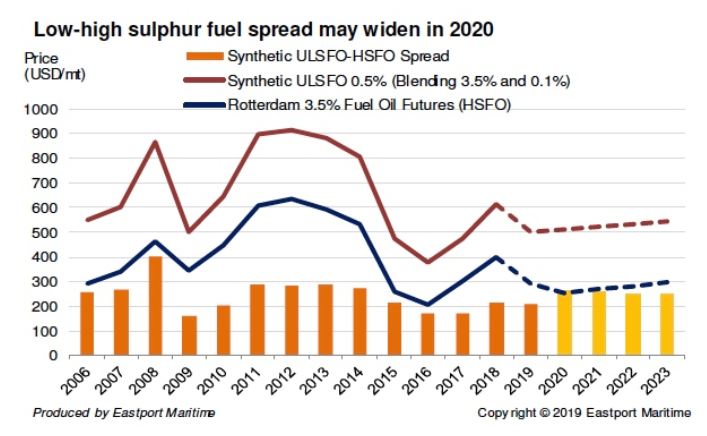

According to Gibson’s ‘Weekly tanker market report’, the gap that was expected at the start of the year, concerning the prices of low and high sulphur was lower. This resulted to experts questioning the payback time, meaning when owners retrofit scrubbers, even though the financial case for scrubber-fitted newbuilds remains intact.

Specifically, in the beginning of January, Taiwan refining CPC published its first general indication for 0.5% LSFO180, which has been priced at a premium of around $100/tonne versus 180 cSt HSFO.

In the meantime, Platts was pricing 0.5% sulphur bunker fuel at an even lower level – just a $40 per tonne premium in Singapore.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

In addition, Gibson’s report noted that the spreads are less than expected by the market in 2020. Yet, this is because the demand for compliant fuel is not important yet.

Moreover, the prices concerning scrubbers will be affected in the possibility that the spread between 0.50% suplhur bunkers and HSFO will be smaller than expected.

The cost of installation in new-builds is not clear yet, as the installation costs less. As a result, the open loop scrubber repayment period will be short, between 9-16 months.

However, there is a possibility that open loop scrubbers will be banned globally as the spread may decrease to negligible levels or HSFO availability might decline dramatically over time.

In conclusion, Eastport Maritime, based in Singapore, resulted to its own fuel price expectations. Oil majors and traders are taking on additional storage capacity to offer the full range of post-cap fuels, with Eastport predicting the storage market in Asian bunkering ports will get tighter as the year goes on.

For more information, click the PDF herebelow: