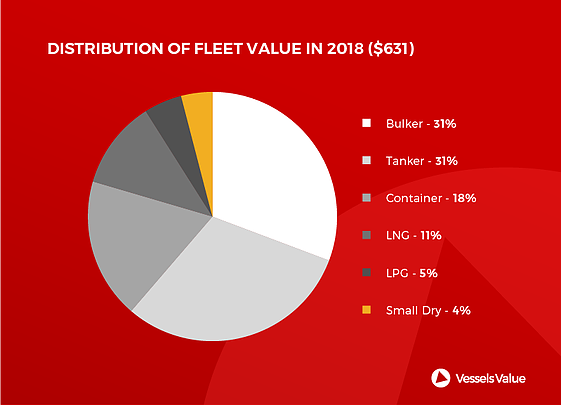

Dry bulk asset values have surged over the past two years following a period of soft returns which encouraged scrapping, while ton mile demand continued to climb, according to data provided by VesselsValue. Hire rates are surging, which is encouraging investment in dry bulk carriers. The dry bulk fleet is now worth more than the combined value of the tanker fleet, leapfrogging container ships as well.

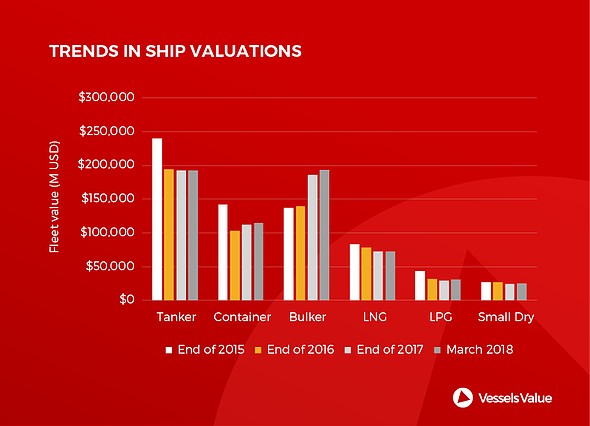

The value of the tanker fleet has slipped by almost $50 billion dollars from 2015 to the present, while bulkers have appreciated by a net $56 billion dollars. The below chart shows the total valuation of each major shipping segment and how it has varied each year from 2015 to the present.

Further, tankers appear to be in the middle of a down cycle, which has depressed the valuation of the tonnage on the water and the outstanding orderbook to second place. Although the top three vessel segments have shuffled places, gas carriers and small dry ships held onto more historic trends. Overall the value of total freight carrying assets fell by about $43bn from the end of 2015.