With the coronavirus spread causing shutdowns on several factories in China, the National Retail Federation (NFR) and the Hackett Associates issued their “Global Port Tracker” report, informing that imports at U.S. retail container ports are expected to experience a drop during February.

In fact, February has been reported as a slow month for imports during the years, since is the Lunar New Year period for China, but due to the coronavirus and its spread, shipping market experiences an unusual situation.

Many Chinese factories have already stayed closed longer than usual, and we don’t know how soon they will reopen. U.S. retailers were already beginning to shift some sourcing to other countries because of the trade war, but if shutdowns continue, we could see an impact on supply chains.

…noted the NRF Vice President for Supply Chain and Customs Policy Jonathan Gold.

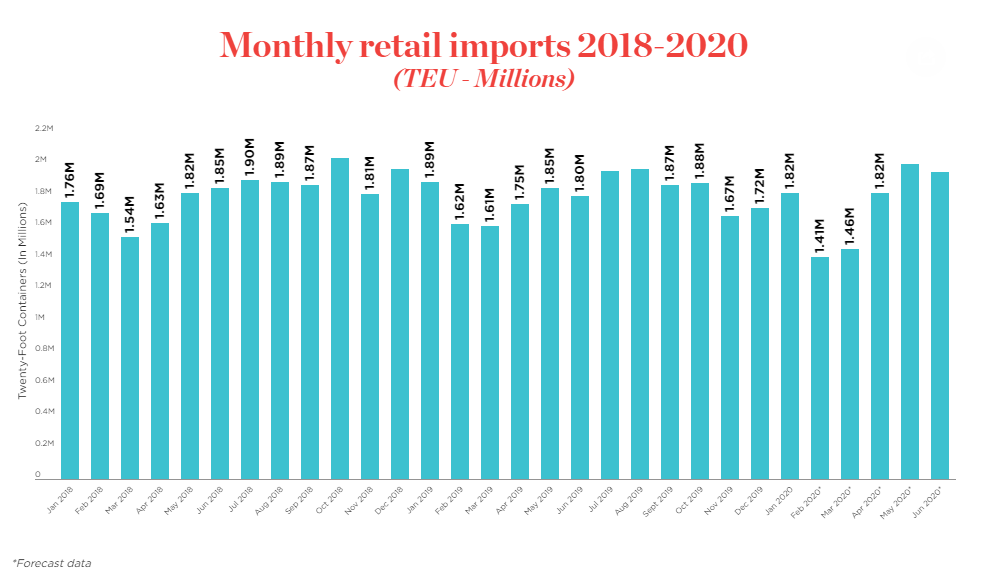

Specifically, NFR forecasts that February will be down to 12.9% year-over-year at 1.41 million TEU, while March is expected to mark a decrease of 9.5% year-over-year at 1.46 million TEU.

Before the coronavirus outbreak, NFR had estimated February at 1.54 million TEU and March at 1.7 million TEU.

Projecting container volume for the next year has become even more challenging with the outbreak of the coronavirus in China and its spread. It’s questionable how soon manufacturing will return to normal, and following the extension of the Lunar New Year break all eyes are on what further decisions China will make to control the outbreak.

… Hackett Associates Founder, Ben Hackett said.

With the coronavirus duration impact still remain uknown, April is expected to see an increase at t 1.82 million TEU, up to 4.5% year-over-year.

For the records, the reports showed that U.S. ports covered by Global Port Tracker, managed to handle around 1.72 million TEUs during December 2019, an 1.8% increase in comparison to November the same year, but down at 12.4% from the same period last year.

Concluding, in light of the coronavirus situation, BIMCO recently highlighted that the extended shutdown of China will temporarily impact the shipping markets and negatively affect freight rates.