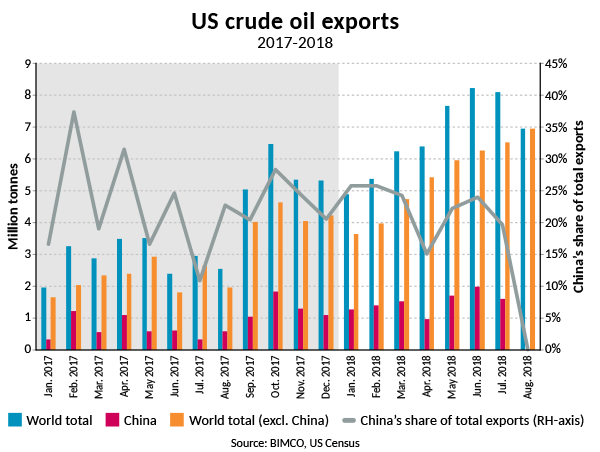

In August there were zero US seaborne exports of crude oil to China. On the other hand, US crude exports to all destinations except from China hit a new all-time high in September at 6.96 million tonnes. The zero US crude oil exports to China is a massive change to the export pattern seen since early 2017, BIMCO said.

Namely, there were rumours that Chinese buyers, led by the world’s top tanker charterer Unipec, would stay away from US crude oil export and this is confirmed by the new data. However, according to BIMCO Chinese buyers returned in early October, something that will determine if these data will eventually show if this is right and to what extent.

Comparing the zero US exports to China with other years, in 2017 Chinese imports accounted to 23% of total US crude oil exports. In 2018 that number was 22% during the first seven months. In August this share fell to 0%.

Providing his comment on this development, BIMCO’s Chief Shipping Analyst Peter Sand believes that the tanker shipping industry is hurt, as distant US crude oil export destinations like China, are swapped for much shorter ones into the Caribbean and South, North and Central America.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

What is more, crude oil is not the only product affected by the trade war. All commodities can be affected regardless whether they are or not in the tariffs list.

What we see in terms of crude oil transport, is harmful to the global shipping industry as well as cumbersome to the exporters and importers of the product.

As for US crude oil exports in regions other than China, they reached a new all-time high record in September, recording 6.96 million tonnes.

Specifically, exports to Asia increased in June and July, from a 43% share of total exports since the start of 2017 to reach a 56% share. In August that share decreased to 46%.

The other main importing regions are:

- Europe (26%);

- North and Central America (18%);

- South America (5%);

- Caribbean (2%).

Moreover, Chief Shipping Analyst Peter Sand mentioned that for the crude oil tanker shipping industry ‘distances often matter more than volumes’. Namely, even though volumes were record high, tonne-mile demand reduced by 19% from July to August because of the change in trade patterns.

Currently for US exports to Asia are by far the most important, BIMCO says, explaing that:

When measuring the tanker demand in tonnes-miles (TM), exports of US crude oil to Asia generated 70% of TM-demand on that trade in August– down from 78% in June and 75% in July.