The continued austerity of the tanker market conditions led owners to dig deep into the oversupply of capacity, with BIMCO expecting the tanker fleet to keep growing. However, a short-term rate recovery is not expected, because of the refining industry’s maintenance season.

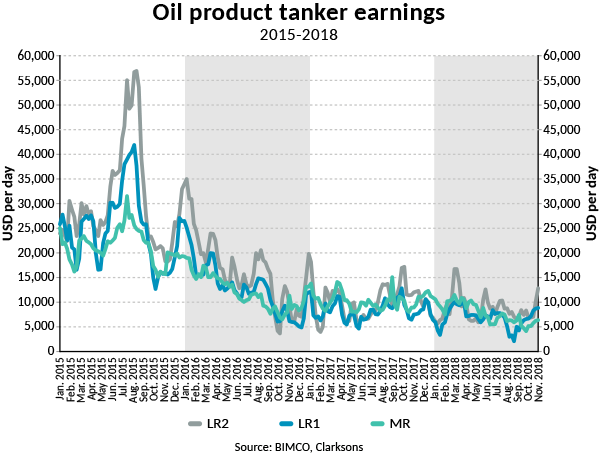

Freight rates

Crude oil tanker freight rates were excellent in October, Peter Sand informs. Namely, monthly average earnings for a VLCC in April and May were less than USD 4,000 per day. In June and July, they increased at USD 7,000-8,000 per day, while in August and September the levels were about USD 11,000 per day. However, October saw average earnings skyrocket to USD 33,500 per day.

According to BIMCO, this increase was partly due to the typhoon season in the North West Pacific, that has disrupted normal shipping business. It also may have tilted the balance in favour of owners. In addition, there were new purchasers in the Atlantic Basin and the Far East.

Fleet

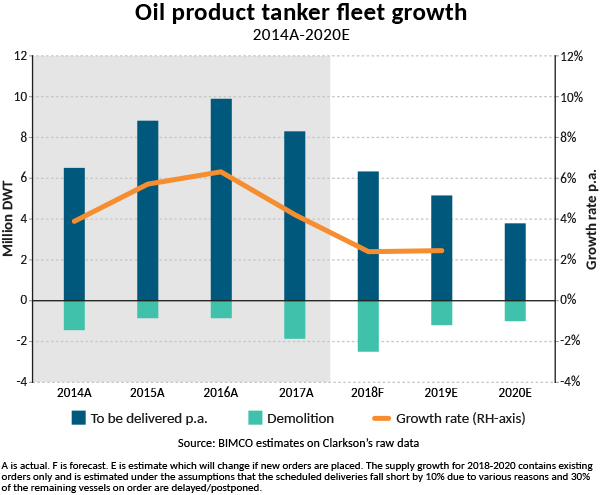

Regarding the oil product tanker fleet, tankers will delivered as predicted, while only eight MR orders are placed at a South Korean shipyard since then. BIMCO’s demolition forecast is also the same, predicting an estimated fleet growth of 2.4%, while its fleet growth forecast remains fixed at 2.4%.

What is more, the crude oil tanker fleet is expected increase by 0.9% in 2018, with many depending on the levels of demolition, going into 2019.

Outlook

As far as tanker rates are concerned, BIMCO expects some volatility this winter due to geopolitical issues. Nevertheless, it also expects some positive seasonality to return.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

Moreover, the US sanctions on Iran on changing trade lanes, but a change away from Iran mainly to other Middle Eastern exporters doesn’t change trading patterns much.

Additionally, IEA has revised its estimations for global oil demand, reducing them for both 2018 and 2019, because of trade concerns, weaker economic outlook, higher prices and a revision of data.

In fact, IEA expects the OECD to increase its oil demand by 0.3m bpd and non-OECD by 1m bpd. For 2019, OECD is expected to drive oil demand by 0.1m bpd and non-OECD by 1.3m bpd.

Finally, the declining price of crude oil indicates that supply is again running ahead of demand. In this aspect, IEA and the US Energy Information Administration (EIA) estimate that global oil inventories will increase during the end of 2018 and the first half of 2019.