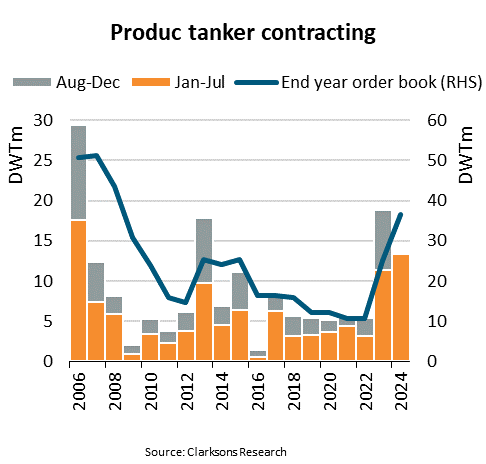

In this week’s “Shipping Number of the Week” from BIMCO, Chief Shipping Analyst, Niels Rasmussen, explores the contraction of product tankers which has reached an 18-year high.

In fact, contracting during the first seven months of this year has reached the second highest level on record.

During the first seven months of this year, 194 product tankers larger than 10k deadweight tonnes (DWT) have been contracted with a combined capacity of 13.3m DWT. This is a 17% increase compared to last year and the highest level of contracting since 2006.

…says Niels Rasmussen, Chief Shipping Analyst at BIMCO.

Contracting during the first seven months of 2024 has reached the second highest level on record while the third highest was achieved last year. Combined, contracting in 2023 and 2024 has rapidly expanded the order book which grew 135% in 2023 and has already grown another 45% so far this year to 37.1m DWT. Chinese shipyards have benefitted the most from the renewed interest in product tanker newbuilding as they sit comfortably on 72% of the order book.

As a result, the order book to fleet ratio has risen from 5.9% at the beginning of 2023 to 13.6% at the beginning of 2024 and now stands at 19.6%. In 2025-2027, 90% of the order book is scheduled for delivery, suggesting a significant potential for fleet growth in that period.

Since the beginning of last year, the product tanker order book has been the fastest growing of all cargo carrying sectors. It has swelled 241% and only the crude tanker order book has come close to matching that development with 151% growth in the same period.

…says Rasmussen.

The average age of product tankers most recently bottomed out in 2011 but has since increased by nearly five years to 13.6 years. Contributing to the relatively high average age, 13% of the ships and 10% of the DWT are currently above the age of 20. Recycling of the older ships could help reduce fleet growth caused by the growing order book.

However, the currently strong market conditions for product tankers do not point to an imminent upwards shift in recycling. Even if recycling in each of the coming three years matches the highest ever annual recycling volume of 3.8m DWT, a maximum of 12m DWT would be recycled before the end of 2027. In comparison, the order book suggests a delivery of 35.3m DWT before then, resulting in a fleet expansion of 23.3m DWT (12.5%) between now and the end of 2027.

While demand for petrochemicals may continue to increase, the demand for product tankers is impacted by decarbonisation, not least the electrification of cars. Unless recycling of older ships increases dramatically, product tanker supply is likely to outpace demand in the coming years.

…says Rasmussen.