According to BIMCO Iran emerged as the number one buyer of US soya beans. Namely, during August 2018, 414,000 tonnes, an amount that equals five Panamax loads of soya beans were shipped to Iran. This amounts to 13.2% of total US soya bean exports in August.

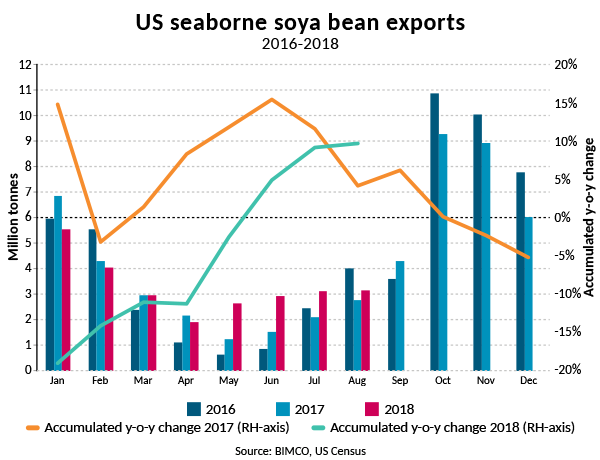

October through to January is peak season for US exports of this key commodity. In terms of seaborne tonnes of soya beans, 31.7 million tonnes were shipped from the US gulf and US North West coast to buyers in China in 2017.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

There were only four months between January 2016 through to July 2018, that the US exported no more than one 82,000 DWT Panamax dry bulk cargo to Iran. In August 2018, 414,000 tonnes were shipped to Iran .

According to BIMCO’s Chief Shipping Analyst Peter Sand, this is positive as ‘from a shipping perspective it’s vital to have continued exports sent to far away destinations’.

In addition, during the first eight months of 2018, the US has exported 7.84 million tonnes of soya beans to China. This is reduced by 3.54 million tonnes from 11.38 million tonnes in the same period in 2017.

In August, the US has shipped only 67,000 tonnes of soya beans to China. This is a reduction of 95% from the 1.2 million tonnes being shipped in August last year.

However, US exports in the first eight months of 2018 were increased by 9.7%, with the peak season about to start.

Namely, Egypt and the Netherlands who have increased their imports the most so far. They are followed by Pakistan, Taiwan, Vietnam, Spain and Iran. These countries have contributed to more than balancing out the 3.5 million decrease in Chinese imports in the first 8 months of 2018 compared to the same period in 2017.

Commenting on this situation, Mr. Sand mentioned:

Going into the final four months of the year (peak US export season), a period that saw China taking 20.3 million tonnes out of the total 28.5 million tonnes last year, it will be increasingly difficult for US exporters to counterbalance lower Chinese imports with new buyers.