Strengthening global growth could be derailed by a range of factors this year, including the coronavirus outbreak and a further escalation of trade tensions, although these tensions seem to be easing for the time being, says Peter Sand, Chief Shipping Analyst at BIMCO.

Namely, the US and China have signed “Phase One” of a trade agreement, which avoids further escalation of the almost two-year trade war; the new US– Mexico – Canada deal has passed into law in the US, with only Canada left to approve it; and a hard Brexit was avoided.

These developments have helped push global growth projections for 2020 up to 3.3%, from just 2.9% in 2019 – the lowest figure since the global financial crisis.

Growth in 2019 was heavily affected by the trade war and is part of the explanation for the percentage point drop in the International Monetary Fund’s (IMF’s) projection for 2018, from 3.9% in its January 2019 World Economic Outlook to the 2.9% in its latest report.

Growth in 2019 was heavily affected by the trade war and is part of the explanation for the percentage point drop in the International Monetary Fund’s (IMF’s) projection for 2018, from 3.9% in its January 2019 World Economic Outlook to the 2.9% in its latest report.

However, these projections were published before the coronavirus (COVID-19) outbreak, and BIMCO therefore expects a adjustment downwards in the next update.

The longer the outbreak remains uncontained, the larger the expected drop in growth, the knock on effects of which will be felt by industries across the world, noted Mr. Sand.

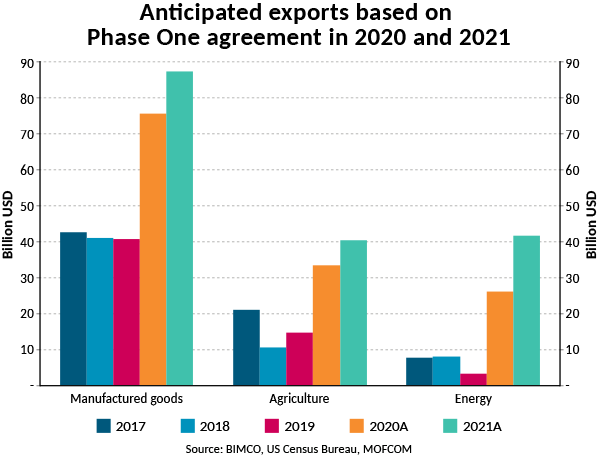

The coronavirus threatens not only the Chinese economy, but potentially that of the entire world. With factories and offices closed for prolonged periods, it could also affect the “Phase One” agreement between the US and China, especially if China finds itself unable to increase its imports from the US by the amounts detailed in the deal.

Meanwhile, dry bulk and tanker trades are directly affected by a lowering of Chinese demand and, given the importance of Chinese imports, disruptions to these segments will affect the entire market.

For containerized exports, the prolonged shutdown in the country’s manufacturing sector limits its ability to meet demand, thereby harming container shipping.

The possibility remains of a further escalation in trade tensions. The majority of tariffs between the US and China remain in place and, as we have seen previously, relationships can quickly turn sour. BIMCO believes it is highly unlikely that a deeper trade deal addressing the underlying problems the US has with China, will be negotiated seriously before the US presidential election in November.

In addition to the US-China trade war, there are mounting concerns about a potential battle between the US and the EU.

France has recently avoided having tariffs slapped on some of its exports after postponing plans for a digital tax, which would primarily hit the large American tech companies.

Moreover, Canada is also considering a similar tax and, despite being US allies, could all face retaliatory tariffs.

For shipping, the fact that tariffs have become a go-to weapon for the current US administration creates a risk of slowing tonne-mile demand growth. Unless alternative trading partners can be found – which becomes increasingly hard, the more countries on which you impose tariffs – the volumes may be lost completely. This would slow exports of the affected goods and potentially any imports used in their production process.