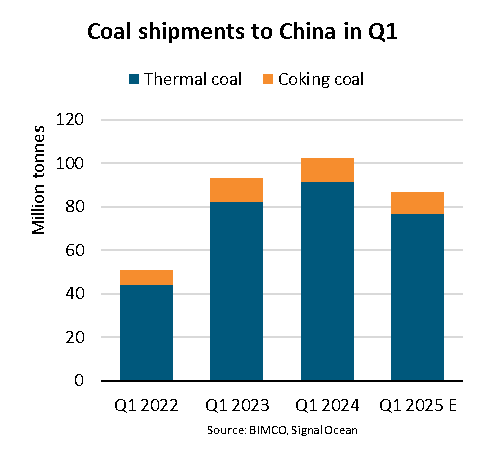

In this week’s “Shipping Number of the Week” from BIMCO, Shipping Analysis Manager, Filipe Gouveia, looks at coal shipments to China which are expected to show a 15% fall y/y during the first quarter of 2025 due to weaker domestic demand and higher competition from domestic supplies and overland import.

Filipe Gouveia stated that the estimation is that coal shipments to China will show a 15% fall y/y during the first quarter of 2025, reaching a three-year-low. Seaborne cargoes have slowed due to weaker domestic demand and higher competition from domestic supplies and overland imports. Thermal coal cargoes have been particularly affected, though coking coal shipments have also decreased.

During the first two months of 2025, thermal coal demand weakened due to a 6% y/y decrease in electricity generation from coal. Total electricity generation fell 1% y/y amid an unseasonably warm winter, and generation from renewable sources continued to rise. Coking coal demand dropped due to a 1% fall in steel production.

During the first two months of 2025, thermal coal demand weakened due to a 6% y/y decrease in electricity generation from coal. Total electricity generation fell 1% y/y amid an unseasonably warm winter, and generation from renewable sources continued to rise. Coking coal demand dropped due to a 1% fall in steel production.

During the same period, domestic mining in China continued to ramp up, rising 8% y/y. A year prior, safety issues in Chinese mines led to a slowdown in mined volumes. However, this seems to no longer be an issue. Imports via rail have also continued to grow, especially from Mongolia, negatively impacting demand for seaborne cargoes.

Tonne mile demand is estimated to have performed even worse than volumes, falling 25% y/y during the first quarter of 2025. Average sailing distances have shortened due to weaker volumes from Colombia and shorter distances for Russian cargoes.

…said Gouveia.

Gouveia highlights that most coal cargoes into China come from nearby countries such as Indonesia, Australia and Russia. So far this year, these countries have accounted for 57%, 16% and 14% of volumes respectively. While the US, Canada and Colombia have only contributed 6% of volumes, they still accounted for 17% of tonne mile demand.

Moreover, of the larger exporters, Indonesia has fared the best with volumes only falling 11% y/y. North American shipments also performed well, with Canadian cargoes surging 42% y/y and US cargoes only falling 10% y/y. This is despite an increase in Chinese import tariffs effective since 4 February.

The panamax segment has been the most popular for transporting coal to China, accounting for 57% of year-to-date shipments. Despite weaker cargo, volumes on panamaxes still increased 1% y/y, crowding out the other segments, partly due to comparatively weaker freight rates.

Looking ahead, the outlook seems timid for coal shipments to China. Import demand could remain low as the country expands electricity generation from renewables, domestic mining and rail links with Mongolia and Russia. Nonetheless, spikes in demand could still occur due to increased electricity use during extreme temperatures or during periods of weaker production from renewables.

…Gouveia concluded.