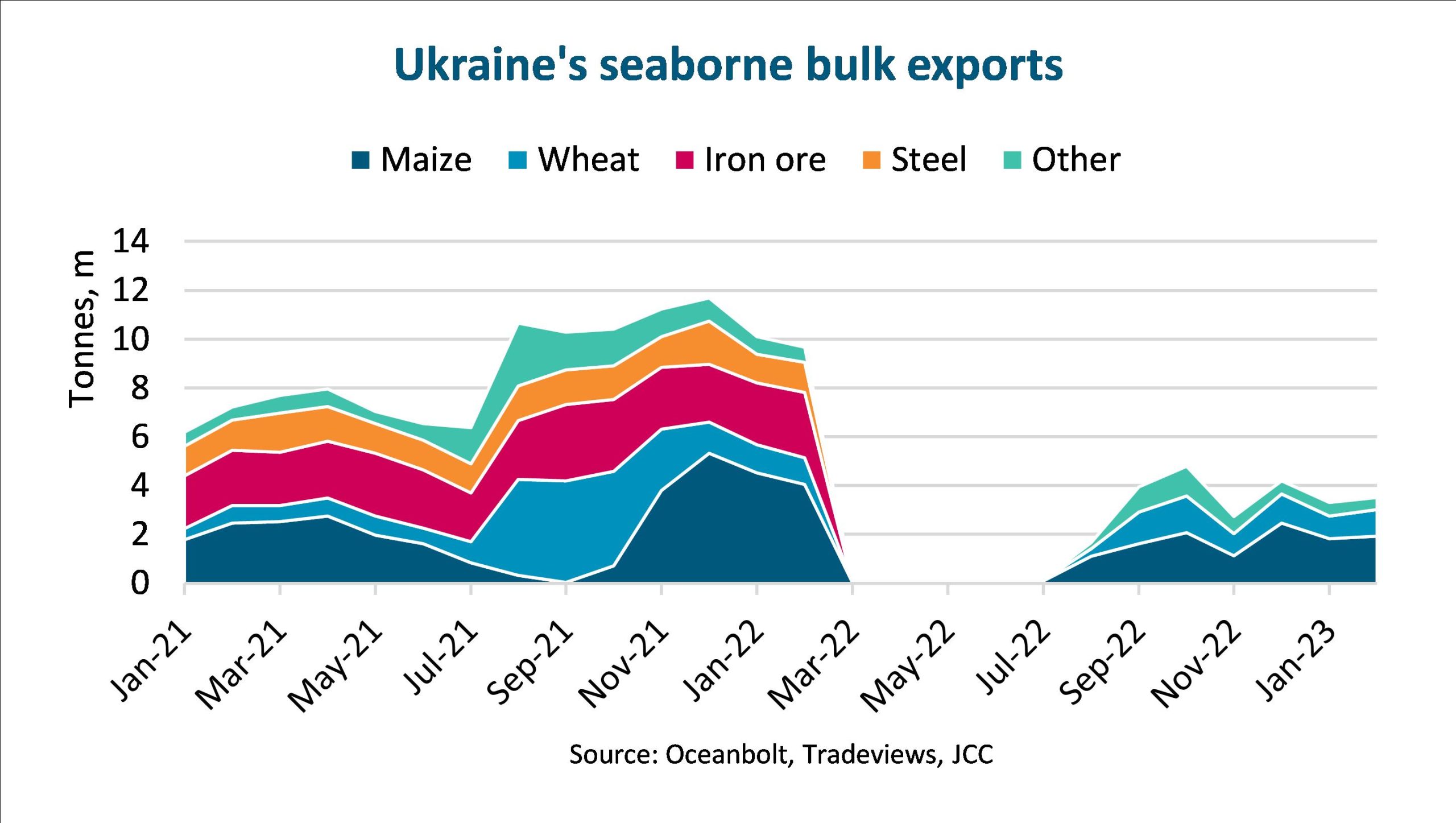

On Friday 24 February, one year has passed since Russia’s invasion of Ukraine. During that year, dry bulk exports from Ukraine have dropped 77.8% compared to the same period a year earlier, causing a decline in global dry bulk volumes, according to BIMCO.

Seaborne exports have been restricted to agricultural goods and even those have been limited, argues Filipe Gouveia, Shipping Analyst at BIMCO adding that Ukraine’s sea ports were under a blockade from the start of the war until the end of July 2022 when the Black Sea Grain deal was signed.

Since then, agricultural exports were allowed to resume from three ports in the Odesa region which accounted for 72.8% of Ukraine’s bulk exports in 2021. The deal is valid until mid-March 2023 and could soon be renegotiated.

Almost twenty million tonnes of bulk agricultural goods have so far left Ukraine under the deal which has helped cool cereal prices and improve food security in low-income countries. However, grain shipments were still down 43.3% y/y between August 2022 and February 2023,

…says Gouveia.

Delays in inspections of ships to and from Ukraine have been a point of contention between Russia and Ukraine. To reduce inspection delays, Ukraine is considering increasing the minimum size for ships carrying grains from 15,000 to 25,000 DWT. Ukraine has also expressed interest in expanding the deal to include the port of Mykolaiv as well as other commodities such as steel. While such a deal would boost bulk shipments, no agreement has yet been made.

Prior to the war, more than one tenth of the world’s wheat and maize shipments came from Ukraine. To compensate, other producers stepped up to fill Ukraine’s gap, often by tapping into their inventories. In the current marketing year, the United States Department of Agriculture (USDA) estimates that global maize exports will fall 9.8%, while wheat exports will rise 2.7%. The limited number of maize exporting countries makes it especially challenging to replace Ukraine’s supplies.

Ukraine remains key to assuring the global supply of maize and wheat. Without a rebound in Ukraine’s exports, the USDA estimates it could take over four years for global maize exports to return to pre-war levels, while global wheat supplies could grow slower than the historical average,

says Gouveia.