Loss-making freight rates shows that the tanker industry is currently battling. Overcapacity, weak ”trading demand” and weak OPEC output have put pressure on the conditions that usually boost long hauls, something that may result in extended losses into 2018.

For VLCC, 2017 was the worst year since 1994, noting an average earnings of just USD 17,800 per day. Suezmax earnings averaged at USD 15,829 per day and Aframax at USD 13,873.

China grew its imports by 10% in 2017, compared to 2016, and a large proportion of it was long haul imports. However, this boost to demand wasn’t enough for the overall market to improve, according to BIMCO.

This highlights another issue, the rebalancing of the global oil stocks. According to the US Energy Information Administration (EIA), the implied stock changes to the world liquid fuel balance in Q1-2018 show a reduction of stocks, for the fifth consecutive quarter. Overall, stocks have piled up to an equivalent of 2.9m bpd since mid-2014, when crude oil prices started to decline. For 2018 and 2019, EIA predicts modest inventory increase.

Since 2016, when OPEC and non-OPEC producers agreed to deliver a coordinated cut in oil supply, global stocks have declined. Despite that, stocks remain significantly above the level they were before oil prices started to drop, causing large stockpiling during Q4-2014 to Q1-2016. The deal to cut oil output will be in effect until the end of 2018.

The reason why global stocks do not continue their decline is because the US oil producers are increasing their output from 9.3m bpd in 2017 to a forecast 10.3m bpd in 2018.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

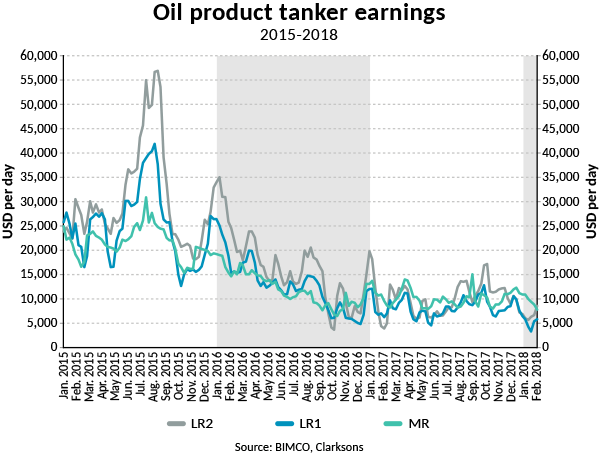

In terms of new tanker orders, 2018 is started slow. The recovery of the dry bulk sector meant that most orders placed in January were for dry bulk ships. Namely, one VLCC, two LR1s, five MRs and six handysize.

For 2018, the VLCC sector will see about 30 units launched, with the MR fleet seeing up to 40 MR-workhorses entering the fleet in 2018.