According to Sea-Intelligence, global demand continues to decline, and the supply/demand balance is under a lot of pressure.

The latest demand data from Container Trade Statistics (CTS) shows that in August 2022, the annualised growth over 2019 was below the level seen in 2019, which means that unless carriers reduce capacity substantially, vessel utilisation will be low.

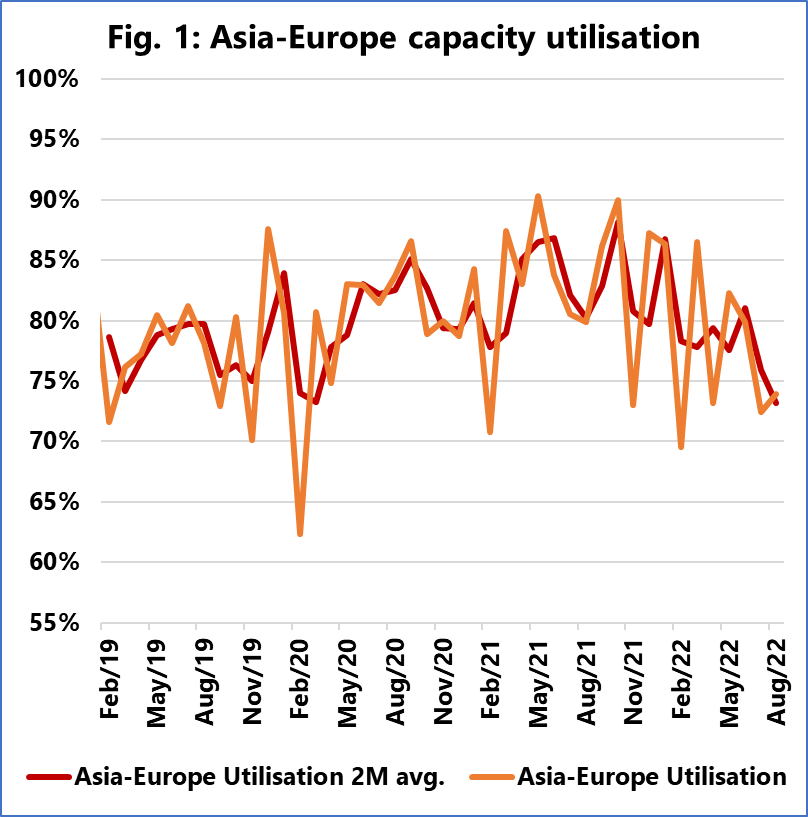

As Sea-Intelligence explains, in order to maintain the ultra-high spot rate levels, a nominal utilisation in excess of 92%-93% needs to be sustained on the Transpacific, with the threshold on Asia-Europe being 85%.

On the Transpacific, utilisation dropped below 90% for much of 2022, becoming a catalyst for the continued freight rate drop. In August, utilisation crossed the 90% mark, but only just, still falling short of the 92% threshold to indicate a rate increase.

On Asia-Europe, utilisation has been dropping even further. In fact, 2022 utilisation on Asia-Europe has been consistently below the 85% threshold to trigger a rate increase, and although the utilisation improved in August to 74% from 72% in July, the rolling 2-month average saw a further decline from 76% to 73%.

This latest data simply reconfirms what has been the case since Spring 2022, i.e. there is no underlying structural support for the high rates on Transpacific and Asia-Europe

Sea-Intelligence concluded.