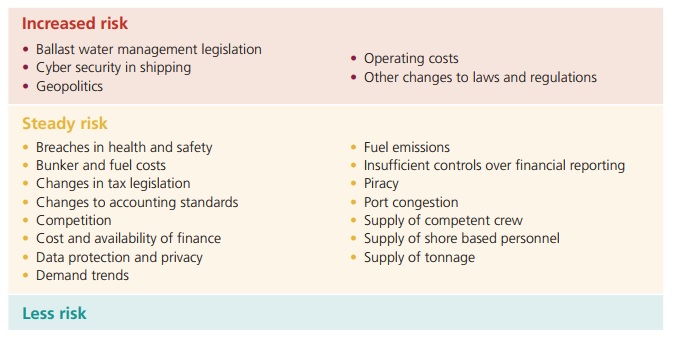

Moore Stephens presents the results of a survey on shipping industry’s risk landscape, revealing a slight improvement over the past year, due to effective risk management. However, shipping still needs to pay attention to its exposure to risk, which is increasing and changing in nature. The survey found that there are many factors which affect risk regardless cyber threats. The factors in shipping which are perceived to have the potential for increased risk are ballast water management legislation, cyber security, geopolitics, operating costs and other changes to laws and regulations.

Respondents to the survey rated the extent to which enterprise and business risk management is contributing to the success of their organisation at an average 6.8 out of a possible score of 10.0, compared to 6.6 last time. Charterers returned the highest rating (8.8) in this regard, followed by owners (6.9) and ship managers (6.8). Brokers returned the lowest rating at 6.3. Geographically, Europe (7.0) was ahead of Asia (6.6), but it was the Middle East which returned the highest figure, at 7.8.

Overall, respondents rated the extent to which enterprise and business risk was being managed effectively by their organisations at 7.1 out of 10.0, up from the rating of 7.0 recorded last time and indeed in the inaugural survey in August 2015. Charterers (8.8) expressed the highest level of confidence in this regard, followed by owners (7.3) and managers (6.9). In the previous survey, charterers recorded the lowest rating (6.5) of the main respondent types.

Demand trends were deemed by the greatest number of respondents to pose the highest level of risk, closely followed by competition and the cost and availability of finance. Demand trends were thought to pose the highest level of risk for owners, charterers and brokers, while for managers it was competition that topped the list.

Geographically, demand trends were the number one concern in Europe, Asia and the Middle East, while respondents in Latin America and North America identified competition as posing the highest level of risk.

Respondents to the survey felt that the level of risk posed by most of the factors which impacted their business would remain largely unchanged over the next 12 months, with the exception of ballast water management legislation, cyber security, geopolitics, operating costs and other changes to laws and regulations, which were all perceived to have the potential for increased risk.

Overall, 69% of respondents (unchanged from last time) felt that the senior managers in their organisations had a high degree of involvement in enterprise and business risk management. Meanwhile, 22% (up from 20% previously) said that senior management’s involvement was limited to “periodic interest if risks materialise”, while 7% (down from 10% last time) noted that senior management “acknowledged but had a limited involvement in” enterprise / risk management. Just 2% (marginally up on the 2016 figure) said that senior management had no involvement whatsoever.

Overall, 30% of respondents (compared to 35 % in the previous survey) confirmed that such risk was managed by means of discussion without formal documentation, while 45% noted that risk was documented by the use of spreadsheets or written reports, compared to 41% previously. Internally developed software was employed by 10% of respondents (17% last time) to manage and document risk, while 14% used third-party software, as opposed to just 5% at the time of the previous survey.

On a scale of 1.0 to 10.0, estimates of claims and provisions (up from 4.2 to 4.3) were deemed the factor most likely to result in a material misstatement in companies’ period-end financial statements. Next came impairment involving vessels in use (up from 4.0 to 4.1), changes to legislation (down from 4.2 to 4.1), and reliance on spreadsheets for financial reporting (up from 4.0 to 4.1). Loan covenant non-compliance, meanwhile, was up from 3.8 to 4.0.

A stand-alone survey question addressed only to publicly traded companies revealed that 80% of such organisations had a dedicated audit committee in place. Respondents in two-thirds of those companies, meanwhile, confirmed that their audit committees met on a quarterly basis to discuss risks, while 22% reported that such meetings were held annually.

Moore Stephens concludes that embedding proper and effective risk

management controls into daily operating procedures is a huge challenge for companies in the shipping sector, where high risk levels are an accepted and fundamental part of the industry. The effective management of risk is fundamental to both safety and commercial success in the shipping industry. The level of effective management of risk must continue to improve. The challenge for companies operating in the shipping sector is to balance risk awareness and risk management with the pursuit of commercial success in an industry which traditionally rewards success commensurate with the informed and acceptable taking of risk. Those who fail to meet this challenge may pay a heavy price in terms of performance, and even survival.

Find out more by reading the survey

Question:

Everyone knows that if a solution is not found the oceans will die along with human species. Still, many Organizations and businesses are getting rich by moving their lower laws and creating obstacles to solving the problems. They prefer it this way for responsibility is not taught in schools or promoted by Governments.

I know all about it, being in innovation, particulary marine, for six decades.

In my drawer, there is an I.P. of a system restoring ship’s balance autonomously without any ballast water. Anyone here who can explain the phenomenon of actively discouraging safety at sea and clean environment?

Sincerely,

Oldrich