Consultancy, Rystad Energy, issued a new report predicting that the world’s supply of offshore wind turbine installation vessels (WTIVs) and heavy lift ships is going to fall short by the middle of the decade, reflecting a coming boom in new wind farm development and the advent of ever-larger turbine designs.

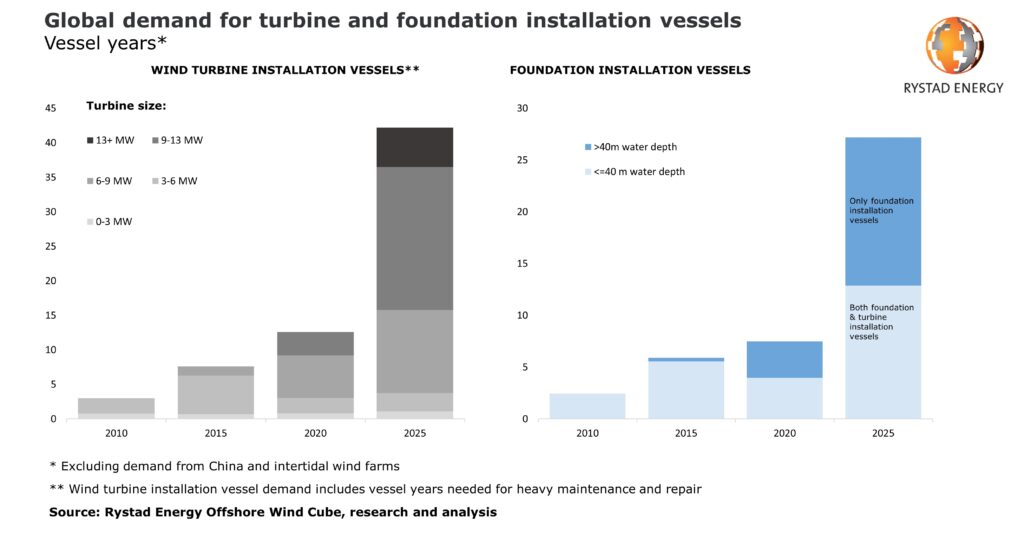

Specifically, Rystad forecasts that the work demand for installation vessels in 2020 is about 8-13 vessel-years, covered by about 32 active WTIVs and 14 foundation installation vessels.

Αlthough it is stated that this is more than enough to meet market needs in Europe at present, global demand will likely increase fivefold by 2030, the company predicts.

It is commented that

The global fleet will be insufficient to meet demand* after 2025, opening room for more specialized vessel orders and other oil and gas heavy lift vessel conversions.

For the time being, there are only four vessels capable of handling the next generation of turbines, such as GE’s Haliade-X 12-MW (or 13-MW in boosted mode), which is expected to be commercial in 2021. As technology advances and future-generation wind turbines will get even bigger, the existing fleet of vessels is not likely to have enough capacity to install them.

Alexander Fløtre, Rystad Energy’s product manager for offshore wind stated that they identify the heavy-lift vessel segment as the key bottleneck for offshore wind development from the middle of this decade, and the need for next generation vessels may slow the cost reductions expected in offshore wind.

The procurement prices for turbines and foundations (jackets or monopiles) account for the biggest costs for a wind farm, but the installation work is also capital intensive. It can consume about 20-30 percent of the total project cost, according to Rystad – up to a billion dollars for a 100-turbine, one-gigawatt project. With about 5-9 vessel-days of work and standby time per turbine, and with a WTIV day rate exceeding $200,000, the revenue opportunity for shipowners adds up quickly.

Fløtre concluded that

Looking ahead, vessels will have to serve the initial construction phase of projects, in addition to maintaining and periodically replacing the active base of equipment. The segment that will succeed in serving the future needs of the offshore wind industry will be able to offer this valuable synergy to support a healthy fleet utilization.