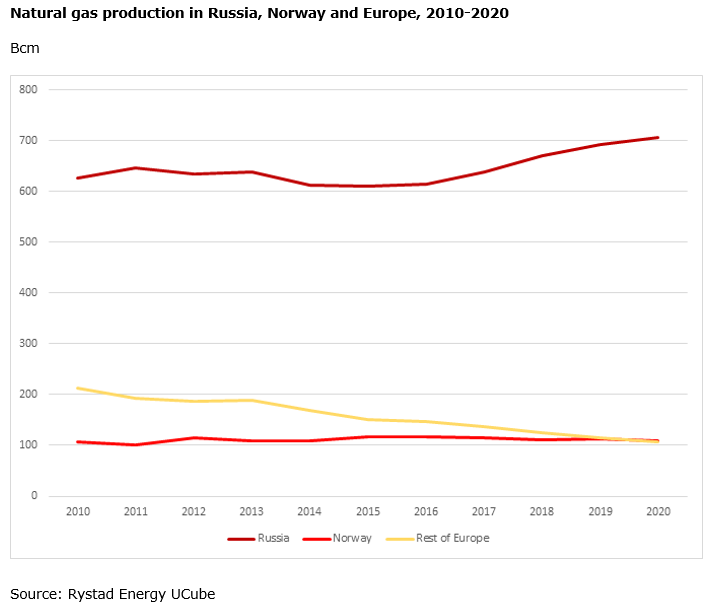

Russian and Norwegian gas exports to Europe -including Turkey- climbed to record levels in 2017, reaching 194 bcm and 122 bcm, respectively, according to data provided by Rystad Energy. This represents a year-on-year increase of more than 15 bcm for Russia and 9 bcm for Norway. Both countries have shown upward output trends since 2014.

Carlos Torres-Diaz, Rystad Energy’s Vice President Gas Markets, stated:

The higher exports have provided reliable supply for Europe and give an indication that the strategy followed by both Russia and Norway has been to maintain their market share, benefiting European consumers as prices in NW Europe have remained rather stable. This has also kept new US supplies of LNG out of the region, enabling American gas to meet increasing demand in Asia and Latin America.

However, while Russia is projected to further strengthen its dominant position, Norwegian output is poised to decline in the coming years, Rystad claims. Annual output from several key gas fields in Norway – Ormen Lange, Aasgard and Kvitebjorn – is expected to decline by 10 bcm by 2020 as compared to their production levels recorded in 2017. This will only be partially offset by the 8.6 bcm increase in projected annual gas output in the same period from the startup of the Aasta Hansteen field. Similarly, production in other European countries is expected to continue declining.

In contrast, Rystad Energy sees increased gas production in Russia going forward. Mr. Torres-Diaz concludes:

“With the ramp-up and expansion of the Yamal LNG plant and the completion of the Power of Siberia pipeline, exports to Asia are expected to increase. However, the increased production, coupled with the continuation of Gazprom’s Nord Stream 2 and TurkStream pipeline projects, leaves large potential for even higher exports to Russia’s main market, Europe.”