Two years ago, the Boston Consulting group highlighted that slow growth in global demand coupled with a persistent oversupply of vessel capacity, was a major industry challenge. Although global container demand did improve in 2017, overcapacity is expected to remain in the range of 6% to 9% in 2020.

Now, the consulting firm highlights that carriers face an increasing threat from digital attackers. A variety of players—including both traditional logistics players and new entrants—are adopting digital technology to provide seamless, end-to-end services.

If these companies’ business models succeed, carriers run the risk of losing direct contact with some of their most profitable customers—primarily small and midsize freight forwarders and beneficial cargo owners (known as BCOs). In this scenario, the carrier’s role could be reduced to providing commoditized ocean freight services.

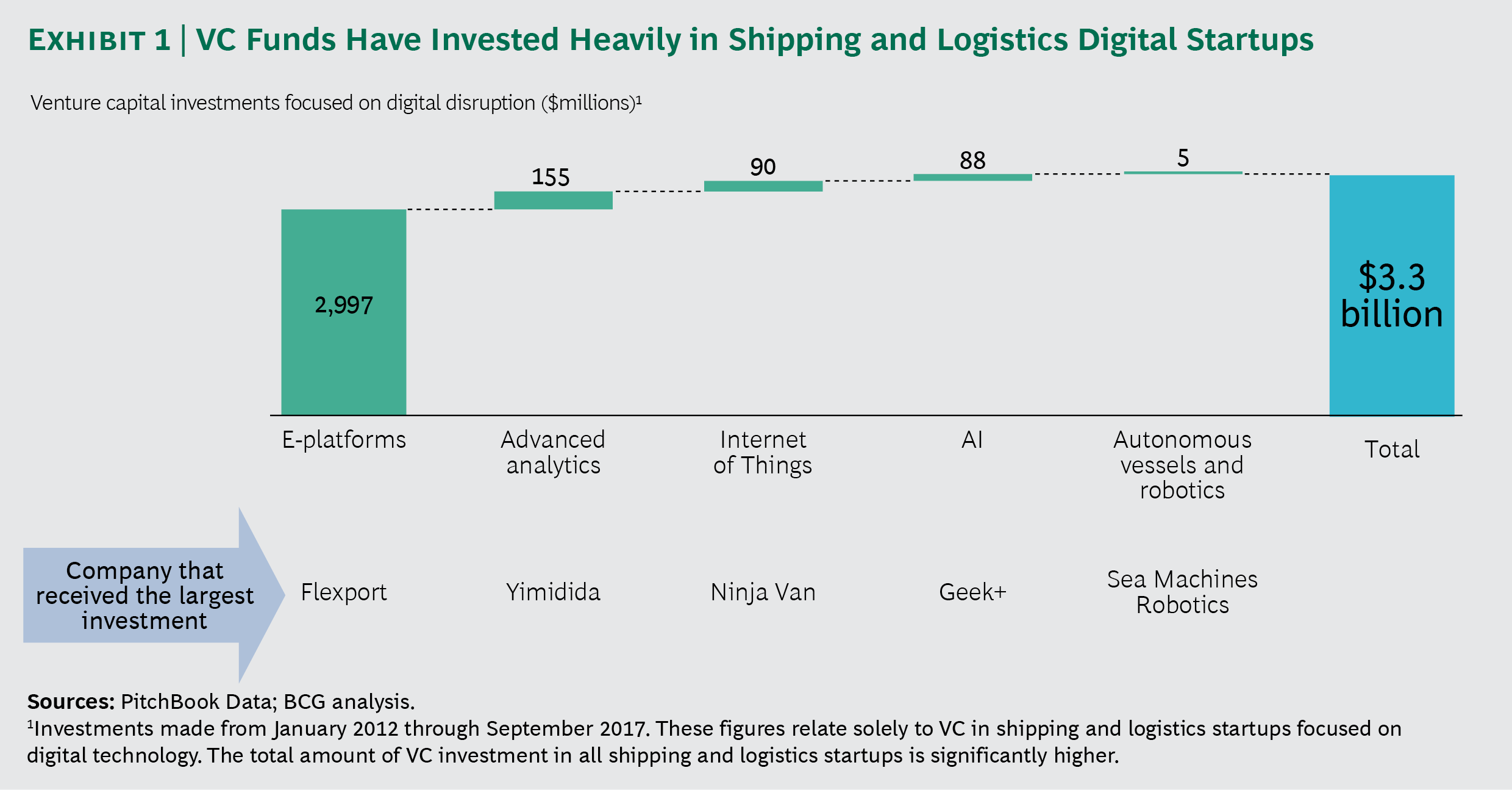

The following infographic illustrates how venture capital investments focused on digital disruption. For example, Flexport is a technology-based freight forwarder that, as of October 2017, had attracted more than $200 million in venture capital investment. Flexport is not alone in attracting venture capital. In the past six years, more than $3.3 billion has been invested in digital startups in the shipping and logistics sector.