As the year is reaching its end, VesselsValue provided an analysis of three key ship types markets, comprising big ship categories Capesize, the LNG, and the medium range (MR1) tankers markets.

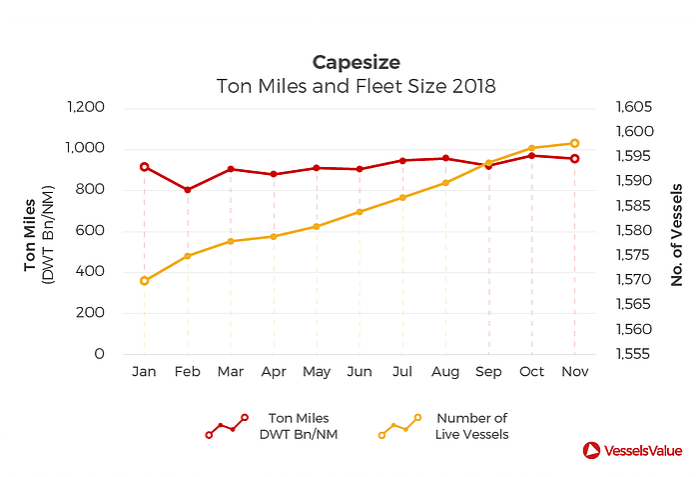

Namely, the Capesize market has experienced an unexpected amount of volatility in year 2018 as the prospect of a trade war between the US and China has created market a climate of doubt for buyers of raw materials. The market faced a decrease in autumn as a result, which then disrupted what was otherwise a strong year for dry bulk ships. The future expectations at the start of 2019 are fundamentally bearish. There is a strong seasonal dip in January and February in ton mile demand, and the fleet size has been steadily rising.

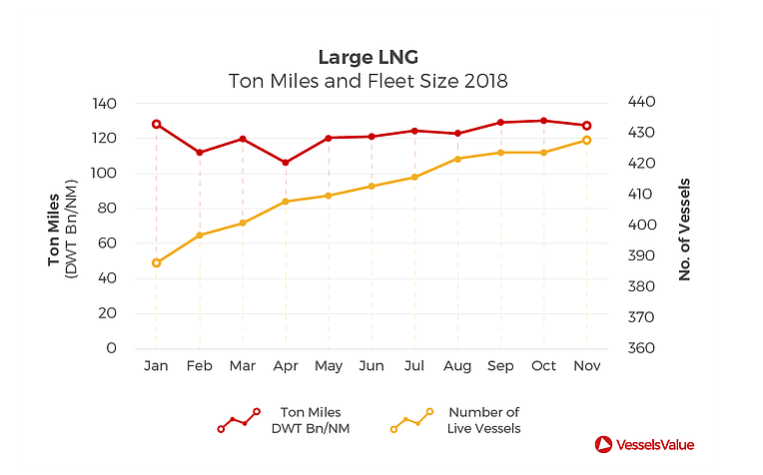

Moreover, the LNG market faces a more complex outlook. The global demand for cleaner fuels has continued to rise and hire rates for ships remain near $200k/day. Yet, a warm winter climate up to now in China has depressed some of the immediate demand, and ton miles have decreased. The long-term prospects for this market are promising, but the market has likely peaked for now.

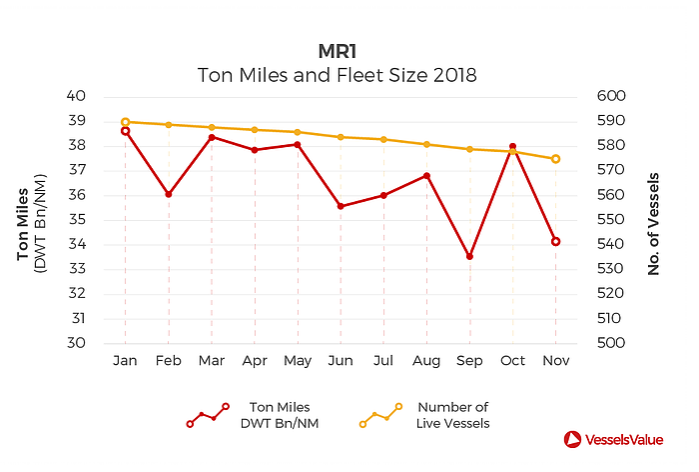

Concluding, the MR1 market appears to be structurally decreasing after enhancements in cargo volumes in 2016 and a steady 2017. However, the fleet size has began to contract, which may help offset some of the drop in demand.