Container equipment rental rates and cash investment returns remain weak, despite last year’s recovery. But an earlier rise in container prices which lifted values to their highest level in five years will continue to put a dampener on returns, according to global shipping consultancy Drewry.

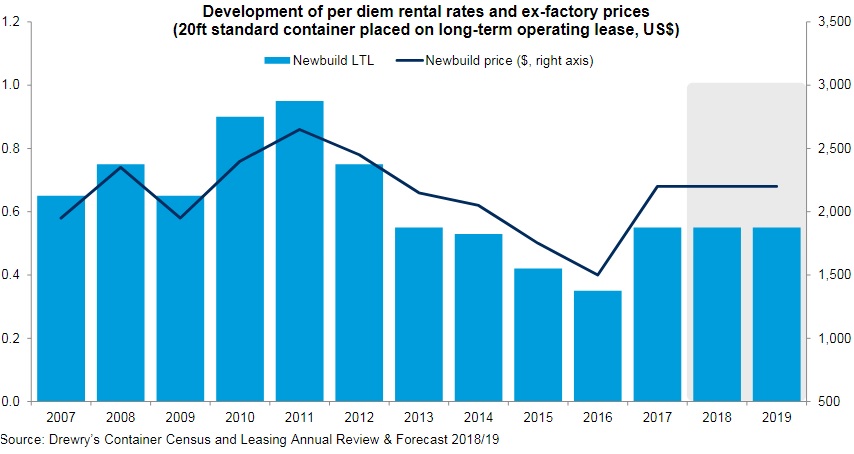

Long-term lease rates for standard dry equipment leapt by over 50% in 2017, having begun their recovery the year before as the Hanjin bankruptcy left large quantities of equipment impounded and therefore out of the market. But newbuild prices rose by a similar margin, limiting cash investment returns to around 9%.

With little change in lease rates anticipated over the next few years, investment returns are forecast to remain under pressure. Although we have seen returns edge up to nearer 10% in the first half of this year, we do not expect these levels to be sustained given recent build-up of factory stocks,

…commented Andrew Foxcroft, Drewry’s lead analyst for container equipment.

With the outlook for world trade looking more promising and growth in ship capacity slowing down, transport operators and especially leasing companies have been vigorously expanding their container fleets. After expansion almost came to a halt in 2016, the container fleet grew by a robust 3.7% last year as the industry hastened to catch up with demand.

The coming years are expected also as good, with container production expected to be above 3.5 million TEU in all four years from 2017-20, which would be the most consistently strong production figures seen in over a decade.

Given that buyers had cut back too much on their purchases in 2016, the latest surge in production – up by 80% in 2017 – has concentrated on standard equipment and particularly the 40ft high-cube. Drewry forecasts that 75% of capacity built in the second half of this decade will be of this type.

This fleet expansion is still being driven by the leasing sector. Shipping lines have focused their investment on ships rather than boxes in recent years, Drewry explains, while the lease sector – invigorated by a series of mergers that has created a new market leader in Triton following its merger with TAL two years ago – is seeing the major players jockeying for position.

Recent mergers have seen the number of big leasing firms slimmed down to Triton, Florens, Textainer and Seaco, and these giants will need to exercise their market muscle to recoup their investments.

Despite persistent utilisation of over 96%, lease rates had been on a long, slow slide through most of the present decade until last year’s recovery. But further uplift will likely be limited and hence returns are expected to remain relatively weak.