Drewry published an analysis on iron ore inventories at Chinese ports and the uncertainty that exists at the global economy that threatens the demand of capesizes. Rahul Sharan, Drewry’s Lead Research Analyst, expects that the demand for capesizes in 2019 will be proportional to iron ore inventories at Chinese ports. Even though China’s steel production will rise in 2019, a further fall in iron ore inventories could adversely affect the demand for dry bulk vessels.

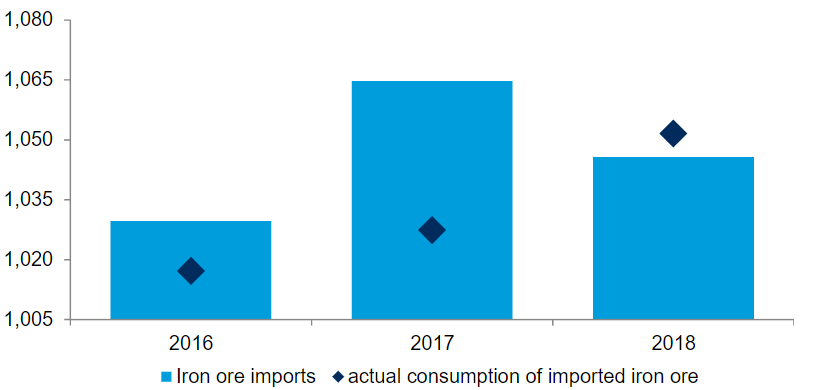

Mainly, Chinese iron ore imports decreased by 1.8% year on year, although the country’s steel production increased at a rapid pace on the same period. Despite the fact that China’s consumption of imported iron ore was indeed higher in 2018 than 2017, imports declined as steel mills preferred to drawdown on port inventories.

Drewry states that the Chinese government will push for infrastructure and easing in monetary policy will continue to drive up the demand for steel in the country.

The government is committed to the clean air goal. Therefore, the country’s steel sector will remain under scrutiny for emissions. This will boost the demand for high quality ore. This will be benefit for the dry bulk sector and will help underpin imports.

In the meantime, Chinese economy increased by 6.6% in 2018 highlighting the slowest rise for the last 28 years. In addition, IMF foresees that the growth will fall to 6.2% in 2019-2020.

As a consequence, sentiment will remain weak and steel mills will remain cautious on future steel demand, compelling millers to continue drawing down on port inventories.

Finally, the analyst reports that the average quarter-on-quarter decline in inventories was about 7 million tonnes and probably in first-half 2019 inventories will keep declining at the same pace.

The majority of the decline in inventories will be a substitution for imports from Brazil, especially as Brazilian export capacity has been reduced due to the recent dam burst. Drewry results that the strong iron ore import growth in China in 2019 is low and for that reason Capesize demand is under threat.