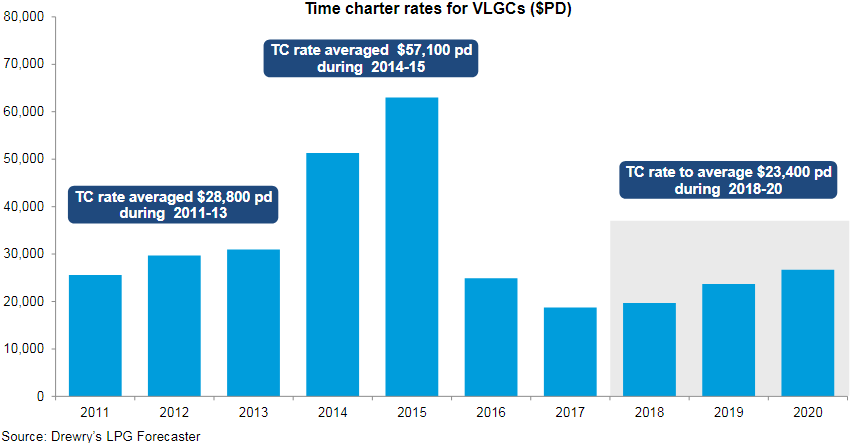

A decrease in fleet growth can trigger the recovery from the second half of 2018 for VLGC owners, despite the fact that freight rates will not reach the levels seen during the bull run of 2014-15, shipping consultancy Drewry said.

2017 was very challenging for VLGC shipping, because the large vessel supply pressured freight market. VLGC earnings in the spot market ( averaged $12,500pd, far below that the break-even rate of $21,000pd.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

Operators are now hoping for a better future, as annual fleet growth is expected to slow down from 16% in 2016-17 to a more manageable 5% over 2018-19. However, new orders are also increasing, with seven VLGCs ordered in the first month of 2018.

Rates are not likely to reach the highs seen in 2014-15, and the sudden pick-up in propane demand from new PDH plants in China. China already has its eight PDH plants up and running, and only two more plants will come on line in 2019.

Shresth Sharma, senior analyst for gas shipping at Drewry, said:

Our outlook for 2018-20 suggests an average freight rate of $23,400pd, below the $28,800pd that was recorded between 2011 and 2013. The reason for the difference between average historical and future rates is that VLGC fleet ownership has become more fragmented since 2013 as many new players entered the market during the boom period of 2014-15. For instance, at the end of 2017, there were 62 companies in the VLGC sector, 17% more than at the end of 2013. It goes without saying that fragmentation tends to reduce the bargaining power of shipowners with charterers.