Despite LNG carriers accounting for a mere 1.45% of the total cargo fleet, the overall value of LNG sale and purchase transactions accounted for nearly 12% of all cargo transactions that took place in 2022, up from 3% in 2021, according to VesselsValue data as of February 2023.

This statistic reflects the surging freight rates and values experienced by the LNG sector in 2022, in the wake of major disruptions to Europe’s gas supply,

As a result of this strong market, older, inefficient steam turbine units have swung from prime demolition candidates to attractive investments, gaining a new lease on life as opportunistic buyers scoop them up for bargain prices.

Prior to the Russia Ukraine conflict, LNG carriers were already in high demand. With LNG cited as a clean burning, more energy efficient alternative to oil, demand for the fuel has been on the rise for the last decade. In 2022, demand would be amplified by a global energy crisis.

In February 2022, the escalation of the conflict in Ukraine precipitated a series of events that led to a massive disruption of the European pipeline gas supply. Over the following months the Nord Stream, Yamal Europe, Turk Stream, and Blue Stream pipelines ceased entirely or dramatically reduced the volumes of LNG being transported into Europe.

Consequently, demand for seaborne LNG spiked as European nations looked to acquire gas from further afield. A combination of vessel undersupply and surging demand led to a huge increase in LNG carrier spot rates, with the BLNG1g reaching a historic peak of 466,524 USD/Day in December 2022, a YOY growth of 27% from the previous peak in 2021.

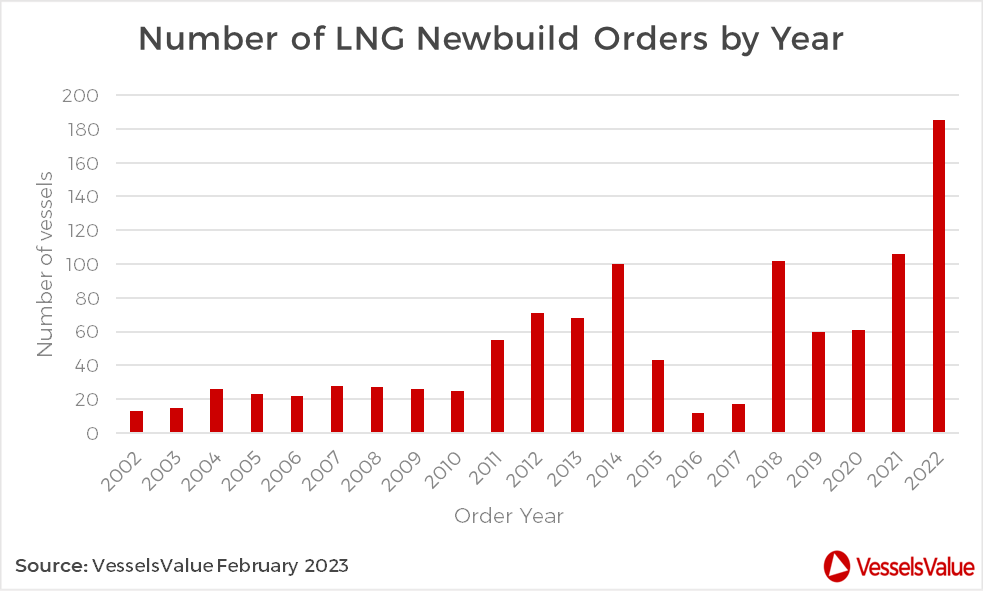

VesselsValue further explains that LNG’s popularity as a fuel has increased substantially over the last decade, and as a result, the LNG carrier sector has seen substantial growth. The number of newbuild orders placed every year has been increasing steadily since 2019, with the data showing a clear upward trend over the last 20 years. The current LNG fleet is therefore extremely modern, with the majority of vessels less than five years old.

Similarly, the fleet is becoming increasingly standardised, with almost all vessels ordered in 2022 due to be built with dual fuel engines, the most popular engine types being DFDE (38%), MEGA (13%) and XDF (12%). Over three quarters of the vessels (75.7%) are due to be built with a capacity of 174,000 CBM.

Similarly, the fleet is becoming increasingly standardised, with almost all vessels ordered in 2022 due to be built with dual fuel engines, the most popular engine types being DFDE (38%), MEGA (13%) and XDF (12%). Over three quarters of the vessels (75.7%) are due to be built with a capacity of 174,000 CBM.

In a less buoyant market, it is likely that older, smaller units would struggle to compete with the large number of modern Dual Fuel tonnage in the fleet and would become candidates for scrapping.

This includes vessels such as the Trader III (Ex Puteri Intan Satu, 137,100 CBM, Aug 2002, Mistubishi HI). This older and smaller vessel, fitted with a Mitsubishi Steam Turbine engine, and out of class, reached a VV Value of USD 29.9 mil on 1st May 2022, only USD 2.5 mil greater than its estimated scrap value of USD 26.5 mil.

In 2022, market factors would combine to make this mature vessel a surprisingly attractive investment. As rates reached historic highs, the earnings potential increased dramatically, and with a large portion of the LNG fleet tied up in long term charters, liquidity in the S&P market was greatly reduced.

Concluding, VesselsValue says that with European storage inventories filled much quicker than anticipated, it is unlikely that we will see a repeat of the soaring rates seen during the scramble for LNG volumes in 2022. However, although 61 LNG vessels are scheduled to be delivered in 2023, most are already committed to long term Time Charters and will therefore be unavailable for spot fixtures. This will serve to keep rates high and ensure that old LNG vessels will continue to find profitable employment in the short to medium term.